What Are Liquidations And Auctions And When Do They Happen?

TABLE OF CONTENTS

- What is collateralization?

- What is a liquidation and when does it happen?

- How does an auction work, and how do I participate in an auction?

- How do I place a bid on an auction?

With the latest update, DeFiChain now supports the minting of Decentralized Assets via it’s proprietary loan mechanism. As a result, it’s now possible to mint, trade and even liquidity mine Decentralized Assets – also known as dTokens – with just a few clicks on your mobile phone, using our brand new DeFiChain light wallet.

In our previous article, we already walked you through the process of creating a Vault, adding collateral to your Vault, and we even showed you how to take out a loan in the form of a dToken like dTSLA or dGOOGL. In this article, we would like to take a closer look at the mechanism behind Vaults and would like to address the following question: What happens when your collateral is no longer high enough to secure your loan?

What is collateralization?

Before we dive deeper into the mechanism behind liquidations and auctions on DeFiChain, we first need to clarify some terms. Firstly, we will look into the term collateralization. Simply put, collateralization is the use of a valuable asset to secure a loan –– in DeFiChain’s case, it’s secured by DFI, BTC, USDT or USDC.

The concept of collateralization is very simple: Think for instance about your home mortgage or your car loan –– two common examples of collateralization. If you stop paying back your mortgage or your loan (so to say, if you default on the payments), then your house or your car will be seized by the lender (bank). The similar thing happens on DeFiChain: When you default on your loan, your collateral will be seized and subsequently be auctioned off to the highest bidder.

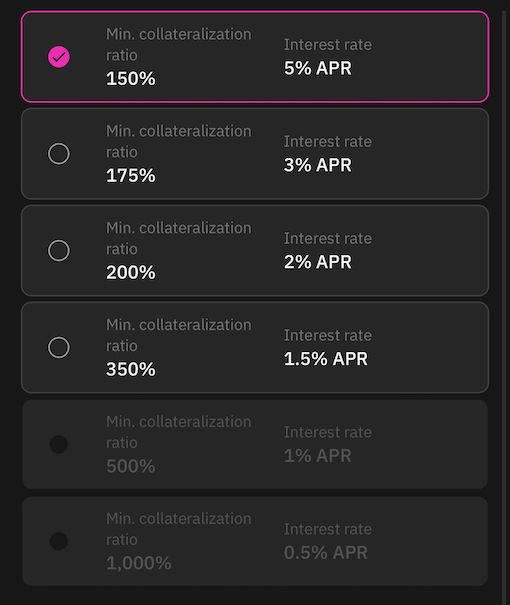

DeFiChain’s loan schemes are built in a way that you need more collateral than what you can take out as a loan. There are a total of six distinctive loan options available: The cheapest starts at a 0.5% annual interest rate (APR) and a minimum collateralization ratio of 1,000%, and the most expensive one is 5.0% APR, at a minimum collateralization ratio of “just” 150%.

But what does this now mean for a user who wants to take out a loan? Well, there are two things to consider: Firstly, the interest rate someone is willing to pay and secondly, the amount of locked up capital to overcollateralize the loan. The ratio of your capital in your Vault (total collateral) and the loan taken out is called collateralization ratio.

Both factors –– the interest rate and the collateralization ratio –– should be taken into consideration when you choose the right loan scheme for your own purpose. Most importantly, though, is to select a collateralization ratio that works best for you in order to prevent a liquidation.

What is a liquidation and when does it happen?

If your actual collateralization ratio of your Vault –– which is calculated automatically and per block –– drops below your minimum collateralization ratio set in the loan scheme, then your Vault is liquidated.

In such an event, the whole collateral of your Vault is put up for action and the highest bidder will ultimately get it. If you want to check the status of your Vault, feel free to visit defiscan.live. It’s a great source of information where you are able to see all details around your own Vault as well as every single Vault currently in existence on DeFiChain.

Let’s have a look at the following Vault to see what information you can get from defiscan.live:

First and foremost you can see the unique Vault ID and the status of your Vault. In the third column, you can see which dTokens have been taken out as a loan. In the next column, you can see how much USD you have taken out for your loan. In the fifth column, you can see the form of collateral that you have put into your Vault, followed by the collateral value in USD. In the last column, you have the current collateralization ratio and your minimum collateralization ratio set as part of your loan scheme.

The owner of this Vault set the lowest possible minimum collateralization ratio and as such he or she can be described as risk averse when it comes to the possibility of being liquidated. The reason for this is that the collateral used to take out the loan over 2172.85 USD would have to drop to 3.258 USD (=150% of the loan value) to enter the liquidation stage. If a minimum collateralization ratio of 500% would have been selected in the first place, then this crucial 500% mark serves as the liquidation trigger and should therefore never be undercut, otherwise the Vault will be liquidated and the collateral auctioned off.

If you want to be as safe as possible, even if that means paying a higher interest rate for your loan, then you should always choose the lowest collateralization ratio which is currently 150%. When choosing a 150% minimum collateralization ratio, the only major drawback is that your annual interest rate is higher than with higher minimum collateralization ratios and is determined by the loan scheme. After all, it’s better to pay a few percent more interest than ever losing your Vault and all your collateral due to a liquidation.

How does an auction work, and how do I participate in an auction?

We already briefly touched on that topic, but let’s have a closer look into the mechanism behind an auction on DeFiChain. As previously mentioned, if your loan value can not be sufficiently overcollateralized, then your Vault enters the liquidation stage.

It’s important to understand that only the content of the Vault –– the collateral –– is auctioned off. The Vault itself will remain in the user's possession. If the loan that has been taken out is rather big, then this loan will be split into several “packages” of roughly 10,000 USD each. Consequently, more people are able to bid on liquidated Vaults, since they don’t need a lot of capital to do so.

On defiscan.live you can see all the details about any liquidated Vault:

The first thing we can see is the liquidation “reason”: The total collateral value in USD dropped below the crucial 150% (in the above example the 5% loan scheme was chosen for this Vault) and thus was liquidated. The total collateral value of 23,195 USD is thus split into three distinctive auctions, no one higher than 10,000 USD.

Users can now bid on each of the three distinctive auctions by offering dTSLA for the collateral in the form of DUSD. The first two auctions are quite lucrative, since a total collateral of 9,282 USD can be “bought” by offering a minimum bid of just 8,161 USD. The initial bid has to be 5% higher than the start value; subsequent bids have to be at least 1% higher.

How do I place a bid on an auction?

There is currently just one way to take advantage of the very lucrative auctions and it involves using the command line on your desktop wallet. It’s important that your desktop wallet is running on the latest version. Do note that the DeFiChain developers are currently working on a graphical interface (GUI) directly on the mobile app. As soon as this is released, we will update the blog post accordingly.

To participate in an auction, you first need to have the respective loan tokens on your desktop wallet. As such, the easiest way would be to send dTSLA, dGOOGL etc. directly from your mobile wallet to your desktop wallet.

Using the command line on the desktop wallet

Using the command line may be a bit tricky if you are not tech savvy and don’t have some coding experience. However, with the following tutorial, it should be easy for anyone to place a bid on an action.

First of all, you have to select the Vault on which you want to bid on. This is done by using the Vaults tap on defiscan.live and clicking on the Vault you want to bid on (assuming its status shows “in liquidation”. In our case we decided to choose the following Vault: Vault ID#:

a54e1a673ee3a3bd2d1bab5760c692f13a6f0fbcd92cf06d9093633a7cc6ff00

Next, you look up the details for this Vault by typing in “getvault” followed by the unique Vault ID# into the command line. Then, just click enter and you should get a response that looks like the one in the following picture:

In the “state” line, you can see that the Vault is in liquidation. The 3 distinctive auctions are characterized by “index”. If you want to bid on the first auction, then you select “index”:0.

Now we want to place a bid for this auction by using the following command:

placeauctionbid <vaultId> <batchIndex> <address> <amount(`value@token`)>

If you type it into the command line, then make sure to use just a “space” in between the four elements: the first one in orange is the <vaultId>, the second one in cyan is the <batchIndex>, the third one in green is your own DeFiChain wallet <address> on your desktop wallet, which you have used to receive your dTokens. The last input in red is the amount you would like to bid: <amount(`value@token`)>.

After you have typed everything in, make sure that your wallet is unlocked and press enter. You should receive a transaction ID (hash) as confirmation. If you now want to check if you are the highest bidder, then just use the first command we have used: getvault

Congrats! You should now see your own wallet address as the current owner, respectively highest bidder of the auction specified by “index”:0.

In case you are outbid by someone else, all your dTokens are immediately sent back to you and will automatically show up in your wallet.

Using the mobile app wallet

This function is not available yet; we will update this section as soon as it's available on the mobile app wallet.

If this was a bit too fast for you, or if you still have some questions, then we would kindly like to ask you to check out the DeFiChain Telegram group. DeFiChain’s amazing community is always here to help you!