What Are Decentralized Assets And How do They Work?

TL.DR:

- Decentralized Assets (or dTokens) on DeFiChain are an entirely new and revolutionary form of crypto investment. These dTokens can be created (minted) by anyone on the DeFiChain blockchain, simply by first locking a minimum of 50% DFI (with the option to add more in BTC, USDT and USDC) into a vault.

- A dToken can then be minted and taken out in the form of a decentralized loan, which is collateralized by crypto. The price when minting a dToken is set by pricing oracles as a point of reference (for example, a TSLA oracle price is used to create dTSLA). A dToken can then either be held as an investment, traded on the DeFiChain DEX, or used for Liquidity Mining on the DEX.

- A dToken’s price moves freely and independently of the oracle price, depending on supply and demand of a given dToken on the DeFiChain DEX. In order to close a loan and get back the collateralized cryptocurrencies, the corresponding dToken has to be paid back with interest, all of which is visible when a user takes out a decentralized loan.

- A dToken can also be purchased directly on the DeFiChain DEX without having to take out a loan. This is applicable for investors who want to invest in decentralized assets without the need for collateralization or dealing with loan interests.

How to start?

1. Buy the native DeFiChain Coin DFI either on Kucoin, Bittrex or Cake Defi. https://cakedefi.com

2. Download the native DeFiChain wallet to control your own keys and be fully in charge of the DEX, etc.: https://defichain.com

3. Either mint the dToken yourself via decentralized loans or buy them on the DEX: https://www.youtube.com/watch?v=ZdmdXpNVqvg

FULL:

Welcome to the world of decentralized assets (or dTokens), where a smartphone with internet access is all you need to buy, trade and hold on to decentralized assets –– similar to the ones you already know from your traditional portfolio, with just a few simple clicks.

In this article, we will take a closer look at the concepts behind decentralized assets and provide a simple introduction for beginners, as well as provide a brief refresher for those with experience in the space.

What are decentralized assets on DeFiChain?

Decentralized assets come in many forms. Some might even share similarities with assets and asset types that you are familiar with. However, it is crucial to work out the differences between them in order to understand their full potential. So let’s dive in.

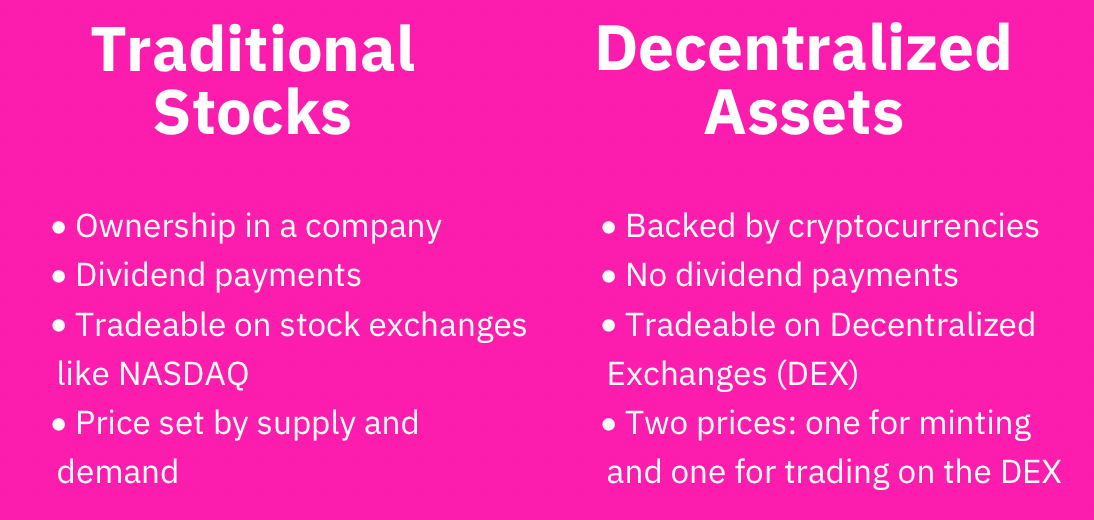

A traditional stock, for instance, is a share in a company. Shareholders are therefore co-owners who have a financial stake in the company. In return for the invested capital, the company gives the shareholder a stock. A stock can only be issued by the company itself and is subject to a number of regulations. Certain rights and obligations go hand in hand with the share, such as the opportunity to have a say or the right to participate financially in the company's success through dividend payments.

Decentralized assets or dTokens on the other hand, are not issued by companies and therefore only exist on the respective platform on which they were created –– in this case, on the DeFiChain blockchain. Unlike other projects that simply offer a form of decentralized stocks that typically track the underlying price of an actual stock issued by a listed company, DeFiChain does not.

Rather than tracking and reflecting the actual stock price issued directly by a company or by a large institution, it tracks and reflects a number of variable factors, and uses oracles to capture those feeds. This means that you are not buying the stock itself, but rather a token that takes these variable factors into account, in a truly decentralised way.

On DeFiChain, dTokens are based on DeFiChain's decentralized lending system. This system allows users to create (or mint) a “representation” of products –– similar to what you know from investing via your bank –– based on oracle pricing. The most important tool required in order to facilitate the creation of dTokens is a Vault. It’s a place where you deposit and lock away your cryptocurrencies and use them as collateral to mint and issue dTokens.

Let’s take a look at how this would look like on DeFiChain. Let's take the Tesla share as an example: The actual ticker symbol for a Tesla share would be TSLA. However, due to the way in which dTokens are minted by DeFiChain users, TSLA becomes dTSLA. Again, it is important to state that the holding of a dTSLA token does not provide the user with ownership of TSLA.

So, these dTokens are minted by users, and any decentralized asset’s inherent value mostly depends on the value that the collective attributes to it (through trading on the DEX). The exchange of these dTokens are facilitated by blockchains and is thus just the logical next step towards an egalitarian financial system for all participants.

Who creates dTokens?

As the name implies, dTokens are created decentrally, which in this case will be DeFiChain users. Every single user is able to mint (or create) a dToken themselves. The prerequisite for creating a dToken on the DeFiChain blockchain is the deposit of collateral. This collateral can be in the form of DFI, BTC or the stablecoins USDT or USDC held in a Vault. At least half of the collateral must be in the form of DFI, the rest can be in any of the aforementioned coins. Decentralized assets on DeFiChain are not securities, but they are backed by cryptocurrencies such as DFI, BTC, etc.

This collateralisation also ensures that dTokens cannot be created out of thin air, and are therefore always collateralised with a higher US dollar equivalent than the sum of all issued tokens combined. This over-collateralization of at least 200% is an essential part of how a Vault works and guarantees that each dToken is backed by an actual value in the form of cryptocurrencies.

However, in order to be able to map a fully comprehensive and functioning financial ecosystem on DeFiChain, interest needs to be introduced. Interest rates depend on the collateralization ratio: If you put a relatively large amount of collateral in your Vault and only use a small part of it to mint a dToken, then you pay less interest than if you were to use a relatively large amount of your collateral to mint dTokens and stay just above the minimum collateralisation ratio of 200%. The same principle is also used by traditional banks: For example, if you take out a loan on your house, you pay either more or less interest depending on the loan value in relation to the value of your house.

Here is a numerical example to illustrate it: Let's say you open a vault and transfer $1,000 worth of DFI and another $500 combined in BTC and ETH into your Vault. As a result, your Vault now has a total value of $1,500, which serves as collateral against the creation of dTokens. Assuming you now decide to create dTSLA tokens worth $100, then this amount is relatively small compared to the total capitalisation of your Vault. Therefore, your Vault in this case is over-collateralised by 1,500% and consequently your interest rate will be relatively low, if you were to choose the highest loan scheme of 1,000%.

However, if you now create dTSLA tokens worth $750, then you will withdraw –– relative to the total capitalisation of your Vault –– an amount equal to the minimum collateralisation ratio of 200% (=$1,500). As a result, you do not qualify for any other loan scheme than 200% and consequently have to pay a higher interest rate. You can find more information about how interest rates work on DeFiChain in our previous article about Loans.

Every good investor has to care about their investment

As you have already read, the minimum collateralisation ratio plays a critical role in the creation of new dTokens. It is therefore up to each user who creates a decentralized asset to ensure that the capital does not fall below this minimum threshold. In case your Vault ever has too little collateralization, it will be put into liquidation and other users can buy your Vault, or more precisely its collateral, in an auction.

However, creating a Vault and thus, creating a dToken is not the only way to get your hands on your favorite assets. It is also possible to buy dTokens easily via the DEX in your mobile app. In this case, you buy the dTokens from someone else that has previously created them in their Vault.

Whichever way you ultimately decide is up to you, because the underlying decision is based on the assumption of each individual and depends, among other things, on the development of the coins that are stored in the Vault. For example, if you assume that DFI and BTC will increase in value and you still want to invest in decentralized assets, then you should transfer DFI and BTC into your Vault and mint a dToken (e.g. dTSLA).

If the dTokens are bought directly on the DEX, then it is the duty of care of each individual to carefully check the current price displayed there. This is because the price shown on the DEX is determined in a decentralised manner by supply and demand. Price oracles do not come into play here; they are only used during the process of minting new dTokens.

So if you mint a new dTSLA token using your Vault, you do so at the price set by the price oracles — which takes into account multiple variable factors and applies them into the price displayed. The dToken on the DEX is independent of price oracles and depends solely on supply and demand.

Accordingly, it can also happen that the demand for a dToken via the DEX exceeds the supply of it created by Vaults. If this is the case, the dToken price on the DEX rises above the price that is traded externally on exchanges, creating a lucrative opportunity for arbitrageurs.

Advantages and disadvantages of dTokens

The most obvious advantage of dTokens is their easy access. All those who value their privacy or simply find it more convenient than setting up centralized trading accounts can download the DeFiChain mobile app and get started right away without verification. All you need is an internet-enabled smartphone and then nothing stands in between you and a 24/7 trading experience.

Since the dTokens are stored on your smartphone, you also don't have to worry about them being taken away; you always have sole access to them.

Another aspect that should not be neglected is that it is also possible to buy smaller amounts of dTokens: You do not have to buy a whole decentralized asset, you can buy just 0.1 or even less. All dTokens are freely denumerable and can be transferred to other people worldwide in no time at all, without having to rely on middlemen.

But that's not all! You can also transfer your dTokens into a liquidity pool and earn additional returns for providing liquidity (liquidity mining). What could be better than profiting from the rising price of a decentralised asset and also receiving liquidity mining rewards that are distributed directly from the blockchain?

On the other hand, as an investor in dTokens, you should also never underestimate the project risk. When any decentralised assets are offered on a new decentralised platform, then we urge you not to transfer your entire portfolio there.

Conclusion

dTokens are available on a large scale for the first time on the DeFiChain mobile app as of the beginning of December. As the name implies, dTokens are created decentrally and every single user is able to mint (or create) a dToken themselves.

Through decentralised assets, it is now possible for everyone to invest in the dToken with very small amounts. In addition, it is possible to profit through liquidity mining, allowing you to put your decentralised asset tokens into a liquidity pool and receive mining rewards for it.

Try it out for yourself and download the brand new DeFiChain mobile app here and become part of the large DeFiChain community.