Decentralized Finance on Ethereum is outdated — Use #NativeDeFi for Higher Security, Cheaper Transactions, and Higher Rewards

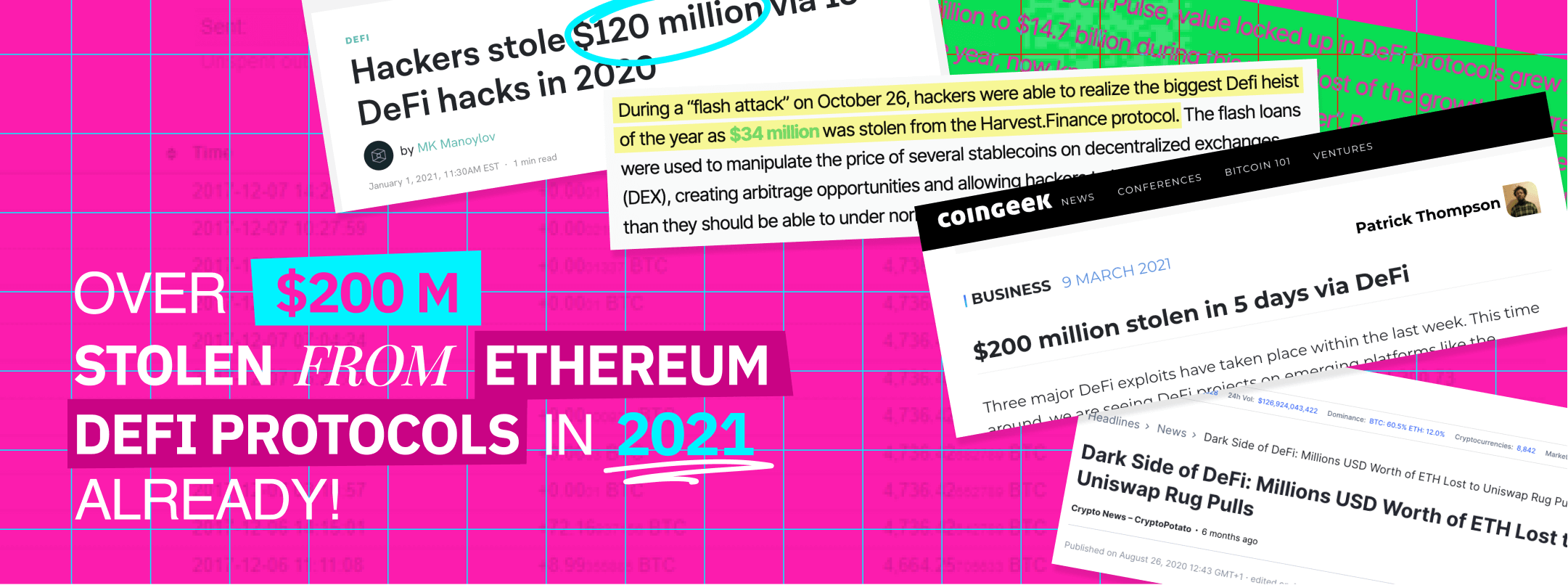

In 2020 alone, hackers have stolen 150 Million USD from Ethereum DeFi Protocols — and in 2021 it’s already more than 200 Million USD that have been hacked!

Security in Decentralized Finance is becoming an increasing issue, and it’s crazy how much money is stolen nearly every day, especially on non-native DeFi protocols sitting on top of the Ethereum blockchain.

In this article, you will learn why Native DeFi built on top of Bitcoin is much more secure, has lower transaction costs, and can even earn you much higher rewards of more than 100% APY, with a coin that actually has intrinsic value.

The Big Benefit of Native DeFi — And Why Decentralized Finance on Ethereum Won’t Be Good, Ever.

The big problem with Decentralized Finance on Ethereum is this: Ethereum is a Turing complete blockchain, which allows you to code almost anything you want on it.

That’s why Ethereum to this day still has the value proposition of basically being a „worldwide supercomputer where anything is possible“.

Now that’s great if you are a developer playing around and working on stuff. The big drawdown, though, is that where anything can happen, anything will happen.

Ethereum is just not made for the world of Decentralized Finance, where it’s neither needed nor important to have a million different user possibilities. In contrast, you want Decentralized Finance Protocols to offer as little attack surface as possible, with only as many functionalities as needed.

All you need in the end is functionality for financial operations like sending, withdrawing, decentralized trading, lending, distribution of dividends, etc. — but not much more. This is the only way to provide proper security in Decentralized Finance, and it is what #NativeDeFi is all about.

DeFiChain — A non Turing-Complete Blockchain Built on Top of Bitcoin and Native to Decentralized Finance

The solution to all these problems is simple: a non Turing-complete blockchain similar to Bitcoin, which is specifically designed for decentralized finance.

In terms of the security and efficiency of DeFi applications on DeFiChain vs. those on Turing-complete blockchains like Ethereum, the latter ones are massively inferior.

Just for comparison’s sake, the same transaction (add liquidity) made once on DeFiChain and once on Ethereum would look like this:

In the picture above you can see an excerpt of the individual steps needed to add liquidity using an Ethereum smart contract.

In total, we are talking about 3,738 steps!

Each of these sub transfers is prone to human errors like coding mistakes and attacks by malicious actors.

Furthermore, the enormous number of steps involved is one of the reasons why DeFi transactions on the Ethereum blockchain are so incredibly expensive.

Contrary to Ethereum, the transactions running in the background on DeFiChain are just a fraction of those needed on Ethereum to add liquidity (see picture below).

The main difference between a transaction which adds liquidity to a smart contract on DeFiChain and on Ethereum is that DeFiChain does it via a native command built directly into the blockchain itself and not coded by any external party.

All that’s needed is to validate that the command is correct and that there are enough funds available. This is sufficient to broadcast the transaction to the DeFiChain blockchain for confirmation.

The big advantages of the DeFi Blockchain

Firstly, significantly higher security, since the blockchain is specifically designed for DeFi applications and is built on top of the Bitcoin blockchain, offering a non-Turing complete function set.

Secondly, much more efficient and thus lower transaction costs (a few cents instead of hundreds of dollars!)

Lastly and most importantly, DFI is a native coin that actually has value and allows for even higher returns than on most other DeFi protocols, with liquidity mining rewards that sometimes far exceed +100% APY.

What are you waiting for? Use #NativeDeFi!

So if you want to use real DeFi and get valuable rewards, download the DeFiChain app, buy some DFI and start Liquidity Mining for Rewards upwards of 100% today!