What is DeFiChain?

Decentralized finance (DeFi) has been making waves in the world of finance, and DeFiChain is at the forefront of this movement. As the largest DeFi blockchain in the bitcoin ecosystem with over $185 million in total value locked (TVL), DeFiChain provides fast, secure, and transparent DeFi services to users worldwide.

This article will walk you through the world of DeFiChain, its unique features, and how it is revolutionizing the DeFi landscape.

TABLE OF CONTENTS

- A Brief History of DeFiChain

- Understanding Decentralized Finance (DeFi)

- DeFiChain's Security Mechanism

- Bitcoin Anchoring

- What is MetaChain?

- Proof-of-Stake Consensus Mechanism

- Where Can You Buy $DFI

- How to Stake Your $DFI

- What is a Decentralized Exchange (DEX)

- What is Liquidity Mining and How Does it Work

- What is a Decentralized Asset and How Does it Work With DeFiChain?

- DeFiChain's Unique Tokenomics

- The Role of DeFiChain Improvement Proposals (DFIPs) and Community Funding Proposals (CFPs)

- The DeFiChain Community

A Brief History of DeFiChain

DeFiChain is a decentralized blockchain platform founded on the principle that people should take charge of their finances personally. This is because existing incumbent systems often fail to provide adequate financial services to their users. The platform's ultimate objective is to grant individuals, and eventually machines and devices, seamless access to decentralized financial services by fully integrating DeFi capabilities into the bitcoin ecosystem.

With these ideals in mind, DeFiChain prioritizes delivering of fast, secure, and transparent decentralized financial services. The platform also aims to introduce comprehensive DeFi capabilities to the bitcoin ecosystem, empowering individuals to have fully control their finances.

In 2019, the DeFiChain team identified the following key challenges to bringing DeFi to the mainstream:

- Reduced risk of hacks: General-purpose platforms like Ethereum require extensive coding for financial services, increasing the risk of hacks or code bugs.

- Gas prices: Scaling issues plague many platforms, as increased dApp usage puts pressure on gas prices for all transactions.

- Centralization: Current blockchain governance models exhibit signs of politicization, centralization, and uncertainty.

- Concentration: DeFi's concentration on a few platforms limits its reach in the broader crypto market.

To address these challenges, the team proposed the following solutions:

- Develop a blockchain dedicated to DeFi use cases.

- Build on top of bitcoin and anchor to the bitcoin blockchain for optimal security.

- Support all major crypto assets.

- Employ a hybrid PoS and PoW consensus mechanism.

- Implement an on-chain governance system.

By overcoming these obstacles, DeFiChain strives to revolutionize the DeFi landscape and make DeFi more accessible, secure, and efficient for users worldwide.

Before we dive into what DeFiChain is, let’s take a moment to understand what DeFi is and how it works.

Understanding Decentralized Finance (DeFi)

To better understand the significance of DeFiChain, let's first explore the concept of decentralized finance (DeFi). As the name implies, DeFi refers to a variety of financial applications in the cryptocurrency or blockchain space geared toward disrupting financial intermediaries.

The technology behind DeFi is inspired by blockchain – the technology behind bitcoin – which allows multiple parties to maintain a copy of the transaction history, preventing any centralized authority from controlling it. This is important because centralized systems and human gatekeepers can impede the speed of transactions while offering users less control over their finances. A key distinguishing feature of DeFi is that it extends the use of blockchain beyond simple value transfers to more complex financial maneuvers.

In other words, DeFi simply puts the traditional financial system – such as banks or any other financial intermediary – on the blockchain. Here are two examples:

- By using the blockchain, you can get a loan from the comfort of your home instead of going to a bank.

- You can perform trades online via decentralized exchanges without a third party. Before DeFi, only those who held and sold cryptocurrencies at the right time could make profits. With the advent of more sophisticated DeFi applications, this will open up a wealth of new earning opportunities for everyone.

DeFiChain's Security Mechanism

As a hard fork of bitcoin, DeFiChain’s programming code is largely similar to bitcoin's; both are non-Turing complete blockchains. What does this mean? Let’s start by looking at what Turing-complete blockchains are.

Turing-complete blockchains allow you to program almost anything you want on the blockchain. Ethereum is the best-known Turing-complete blockchain at the moment. Although Turing-complete blockchains are open and flexible, they are prone to errors and malicious attacks. We have seen this occur on a few occasions, when Ethereum-based applications were hacked and millions of dollars were stolen.

Conversely, non-Turing complete blockchains like DeFiChain’s UTXO layer provide fewer programming possibilities, which leads to a smaller attack surface. This prevents arbitrary code from running on non-Turing complete blockchains, only allowing “predefined” code to be executed. This is a crucial design feature of DeFiChain’s UTXO layer, as financial products require a high level of security that can only be achieved by a non-Turing complete architecture.

The upcoming MetaChain layer will see DeFiChain transitioning into a hybrid architecture, offering a Turing and non-Turing-complete architecture to interact with the blockchain.

Bitcoin Anchoring

DeFiChain is not only a hard fork of bitcoin with a non-Turing complete function set, but it is also periodically anchored on the bitcoin blockchain. This means that every few blocks, a specific data set from DeFiChain is stored on the bitcoin blockchain. In this regard, it is important to note that:

- In the event of a 51 percent attack, where someone holds more than 50 percent of the coins, the blockchain can only be reverted to the point at which the last anchor occurred.

- This also implies that a 50 percent attack is fairly unattractive from an economic standpoint, meaning that DeFiChain is secure despite its nascence.

What is MetaChain Layer?

The MetaChain layer is the evolution of DeFiChain, achieved by integrating the Ethereum Virtual Machine (EVM) with DeFiChain; for this reason it can also be known as the EVM layer. Through this integration, DeFiChain will no longer be held back by its restricted application scope, opening the doors to greater innovation in the ecosystem.

The integration of the EVM will split DeFiChain’s ecosystem into three distinct domains: UTXO, token systems, and Ethereum Virtual Machine (EVM) accounts. Each of these domains will run independently of each other, preserving the UTXO model to enable precise and transparent accounting across the ecosystem.

To facilitate movement between domains on DeFiChain, users must deploy the Transfer Domain Transaction (TX). TX is the exclusive method for transferring assets between different domains to establish a coherent accounting layer. Using the TX, users can effortlessly and securely navigate their assets within the DeFiChain ecosystem.

The DeFiChain Virtual Machine (DVM) is the heart of DeFiChain’s ecosystem, serving as the platform's native virtual machine. The DVM plays a crucial role in the DeFiChain ecosystem, empowering users to transfer balances between domains and utilize DeFi, offering additional functions such as the decentralized exchange (DEX) and governance models.

To learn more about DeFiChain’s MetaChain layer, check out these articles:

- The Evolution of DeFiChain: From UTXO to MetaChain

- DeFiChain’s New Architecture: EVM and UTXO Integration on DeFiChain

Proof-of-Stake (PoS) Consensus Mechanism

Due to its slow transaction speed and high transaction costs, bitcoin has limited scalability. Thus, DeFiChain chose the proof-of-stake (PoS) consensus mechanism over bitcoin's proof-of-work (PoW). In principle, PoS ensures transactions are verified not by hash power but by the number of people holding the coins (aka the stakers).

PoS has three key benefits::

- Transactions on DeFiChain are significantly cheaper and faster than on the bitcoin blockchain.

- PoS makes it much easier to decentralize a new project, compared to PoW’s complex distribution of computing power.

- PoS enables staking. Staking eliminates expensive mining equipment and uses coins – in this case, DFI – to verify transactions and protect the network. In exchange for this service, stakers receive rewards from the blockchain.

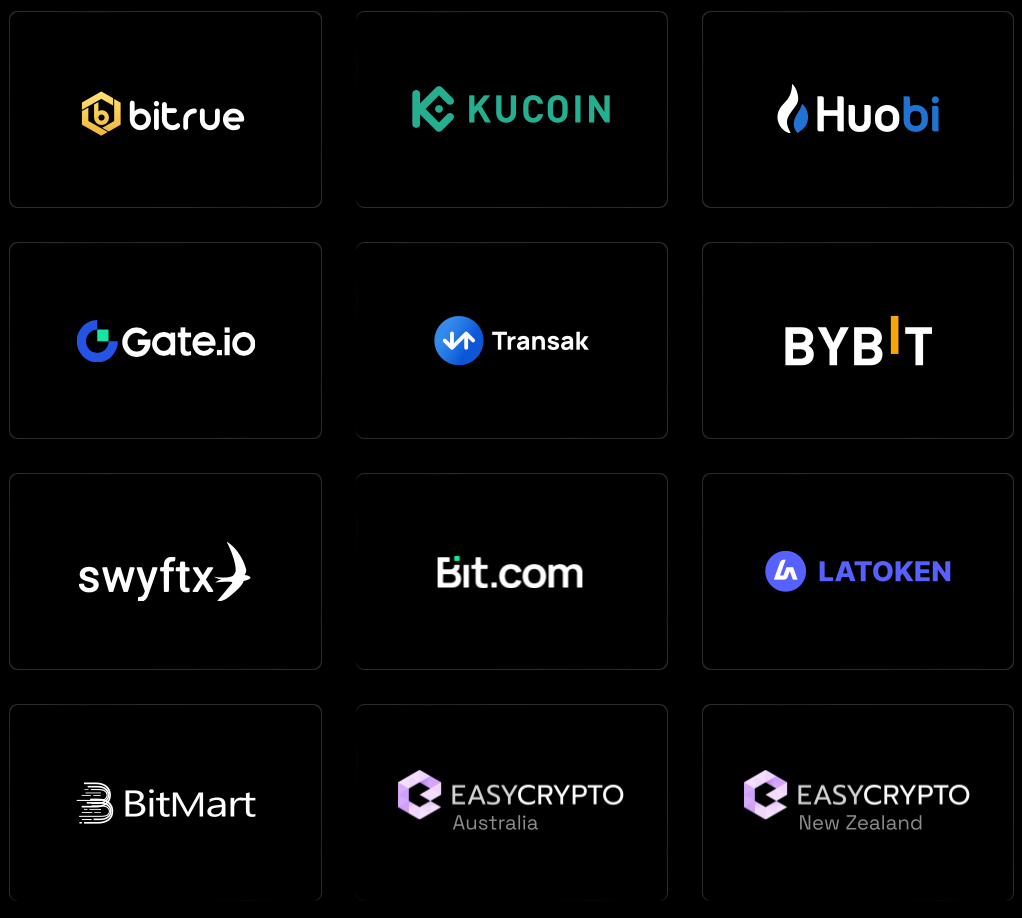

Where Can You Buy $DFI?

Your next step is to buy DeFiChain’s native coin $DFI and transfer it to a DFI-compatible wallet address. Here’s a list of trusted exchanges where you can buy $DFI:

How to Stake your $DFI

Staking your DFI (DeFiChain native tokens) is a straightforward process. Here are some ways you can get started:

1. Set Up a Masternode with 20k $DFI

If you own at least 20,000 $DFI, you can take the Masternode route via the Desktop Wallet Console. You’ll become a Masternode owner, a prestigious role that allows you to contribute to DeFiChain’s security and nets you extra staking rewards in the form of $DFI tokens.

2. Leverage Staking Service Providers

If you have less than 20,000 $DFI, you can invest $DFI with staking service providers. These platforms pool together $DFI from multiple participants to collectively spin up a Masternode. The staking rewards generated are then distributed proportionally among all contributors based on their respective pool shares.

A variety of staking providers are available to cater to your specific staking needs, ensuring everyone, regardless of their $DFI holdings, can participate and reap the rewards. Some notable staking providers include:

What is a Decentralized Exchange (DEX)?

Let’s now set our sights on DEXs, the engines powering DeFi applications like liquidity mining.In traditional finance, exchanges predominantly adopt an order book model. A centralized database houses all the user-inputted buy and sell orders at various prices. When a match is identified between a set of buy and sell orders, the transaction is executed.

DeFi changes up the traditional method with an innovative order book mechanism: the Automated Market Maker (AMM). AMMs have reshaped the trading landscape by enabling permissionless cryptocurrency exchanges between users, leveraging liquidity pools and eliminating centralized entities from the equation. These pools are anchored by smart contracts and operated by algorithms, ensuring they operate autonomously.

By encouraging participants to deposit their cryptocurrencies, these pools acquire greater liquidity. This, in turn, facilitates more capital-efficient exchanges for users, curtails slippage, and amplifies the volume of cryptocurrencies users can acquire.

What is Liquidity Mining, and How Does it Work?

Liquidity mining is a notable DeFi application where participants lock their cryptocurrency assets in liquidity pools and are rewarded with tokens and fees.

These participants are called liquditiy providers (LPs). LPs typically earn LP tokens that can be exchanged for a share of the trading fees the platform accumulates. The distribution of these fees varies depending on the volume of liquidity provided by the LP.

History of Liquidity Mining

Liquidity mining experienced a surge in popularity in Summer 2020, a period colloquially dubbed as "DeFi Summer." DeFi received greater recognition during this time, its efficient, permissionless trading framework attracting a plethora of market participants.

New users were also drawn to DeFi by the allure of high yields, with some protocols offering annualized percentage yields (APYs) in triple digits or even higher.

This period was especially lucrative for LPs, who were rewarded with a larger share of their protocol’s transaction fee distributions when they supplied more capital. This made trading more appealing, amplifying the volume of activity across various protocols.

Presently, many protocols record a significant drop in APY values, signifying the market has become mature and sustainable. Despite this adjustment, DeFi protocols continue to hold strong, with participants perpetually on the lookout for the next promising opportunity.

How to Start Liquidity Mining on DeFiChain

Liquidity mining on DeFiChain is easy. Here’s how to get started:

- Download the DeFiChain Wallet from the Apple App Store or Google Play Store.

- Tap on “DEX” and scroll down to the Liquidity Mining pair you’d like to invest in and click on it.

- Scroll down and tap on “Add liquidity.”

- Enter the amounts you’d like to invest and choose to “Continue”

- Tap on “Add liquidity”

That’s it! Your coins are now in a Liquidity Mining pool and will start generating rewards for you.

Benefits of Liquidity Mining

Generation of Passive Income

Liquidity Mining is the best way to generate passive income in the cryptocurrency world. The strategy behind providing liquidity to pools is often a passive one; you merely retain your LP tokens in the pool of your choice, and your rewards seamlessly accrue in proportion to your holdings.

More importantly, when you provide liquidity to a pool that atrracts market participants, the growth in activity will translate to greater rewards for you. This way, you can benefit from changing market conditions without actively managing your position.

Potential for High Yields

As a general rule of thumb, your potential yield increases when you invest more assets into a liquidity pool. This makes liquidity mining ideal for all risk appetites. Whether you’re dipping your toes into the scene or fully committing to the strategy with a huge investment, liquidity mining can be adjusted to suit your needs.

For DEXs (Decentralized Exchanges) to function effectively, a certain level of liquidity is required, catering to traders who want to swap their tokens across different cryptocurrencies. When you provide liquidity in this manner, exchanges are incentivized to reward you for your contributions.

Your investment plays a pivotal role in enabling decentralized transactions, with the ensuing rewards predominantly stemming from trading fees generated with each transaction. Since your share of the liquidity pool dictates what your yields are, you can estimate what your rewards will be before getting started.

In scenarios where there are a lot of trades in the markets, the rewards distributed by protocols have the potential to be high — eclipsing the returns offered by traditional bank deposits.

What is a Decentralized Asset, and How Does It Work With DeFiChain?

Decentralized assets come in many forms, with some sharing similarities with traditional assets and asset types. However, it is crucial to work out the differences between them to understand their full potential.

A traditional stock, for instance, is a share in a company. As a shareholder, you’re a co-owner with a financial stake in the company. In return for the invested capital, the company gives you a stock. A stock can only be issued by the company itself and is subject to a number of regulations. Certain rights and obligations go hand in hand with the share, such as the opportunity to have a say or the right to participate financially in the company's success through dividend payments.

Decentralized assets or dTokens (as they are known on DeFiChain), on the other hand, are not issued by companies and thus only exist on the respective platform on which they were created –– in this case, on the DeFiChain blockchain. Unlike other projects that offer a form of decentralized stock that typically tracks the underlying price of an actual stock issued by a listed company, DeFiChain does not.

Rather than tracking and reflecting the actual stock price issued directly by a company or by a large institution, DeFiChain tracks and reflects a number of variable factors and uses oracles to capture these feeds. This means you’re not buying the stock itself, but rather a token that takes these variable factors into account, in a truly decentralised way.

On DeFiChain, dTokens are based on its decentralized lending system. This system allows users to create (or mint) a “representation” of real-world products –– similar to what you know from investing via your bank –– based on oracle pricing. The most important tool required in order to facilitate the creation of dTokens is a Vault. It’s a platform where you deposit and lock your cryptocurrencies and use them as collateral to mint and issue dTokens. Learn more about Decentralized Assets on DeFiChain here

DeFiChain's Unique Tokenomics

Like bitcoin, DeFiChain has a maximum supply of coins. The maximum number of bitcoins that will ever be in circulation is 21 million, while the number of DeFiChain coins is 1.2 billion. More stats of DeFiChain can be found here.

DeFiChain's native coin, $DFI, plays a central role in the platform's ecosystem. It serves as a utility token that facilitates transactions, powers applications, and incentivizes users to contribute to the network. Here's a closer look at some of the unique aspects of DFI's tokenomics:

- No Public Sale, ICO, or IEO: Unlike many other projects, DeFiChain did not conduct a public sale, initial coin offering (ICO), or initial exchange offering (IEO). This decision was made to ensure a more decentralized distribution of tokens and to avoid regulatory complications.

- Incentives and Rewards: DFI are used to reward users for participating in various activities within the DeFiChain ecosystem, such as liquidity mining, staking, and contributing to the platform's governance. This incentive structure encourages users to engage with the platform actively and fosters a vibrant and collaborative community.

- Utility and Value: DFI coins serve as the primary means of exchange within the DeFiChain ecosystem, powering transactions and facilitating the use of various applications. As the platform grows and attracts more users, the demand for DFI coins may increase, leading to potential appreciation in value.

The Role of DeFiChain Improvement Proposals (DFIPs) and Community Funding Proposals (CFPs)

DeFiChain's governance system encourages community involvement and empowers users to shape the platform's future. DeFiChain Improvement Proposals (DFIPs) and Community Funding Proposals (CFPs) are two essential components of this process.

- DeFiChain Improvement Proposals (DFIPs): These are proposals aimed at modifying a fundamental aspect of the blockchain or its underlying mechanism. Anyone can submit a DFIP by paying a fee of 50 DFI.

- Community Funding Proposals (CFPs): These are proposals designed to finance a specific project that benefits both the community and the entire DeFiChain ecosystem. Individuals can submit a CFP by paying a fee of 10 DFI.

During monthly voting rounds, masternode holders evaluate each proposal and decide whether to approve or reject it. It is essential for submissions to adhere to strict deadlines; however, in exceptional cases, the core team may initiate an emergency vote. This governance structure ensures that the DeFiChain ecosystem evolves and adapts to the needs of its users, fostering a dynamic and responsive environment.

The DeFiChain Community

The DeFiChain Community is very active and constructive, primarily on the subreddit /r/defichainblockchain. Users in this subreddit discuss critical issues, propose improvements, or simply initiate leisure discussions.

These discussions often result in improvement proposals (DFIPs or DeFiChain Improvement Proposals) or requests for community funding (CFPs or Community Fund Proposals).

The community is also very active on the following channels: