New Features to Align DUSD With USD

We just introduced our new Liquidity Mining product on decentralized assets today. From now on, it’s possible to generate a regular income by utilizing the full potential of your decentralized assets such as dTSLA or dGOOGL with just a few clicks on your mobile phone using our brand new DeFiChain light wallet.

DeFiChain’s Liquidity Mining on decentralized assets is based on its loan feature and follows sound game theoretical principles. All 15 newly introduced decentralized assets, also called dTokens, are trading against DUSD –– also a dToken, whose value is supposed to be very close to USD, but ultimately depends on demand and supply on the decentralized exchange (DEX).

How comes that the DUSD price can diverge from 1 USD?

Let’s say you would like to participate in the dTSLA-DUSD Liquidity Mining pool with your dTSLA tokens, then you also have to supply the same value of DUSD to be able to enter the liquidity pool and generate liquidity mining rewards in return for supplying liquidity to this pool.

The strategy of using a Vault to mint dTSLA & DUSD guarantees that you always get the “outside price” for both tokens –– you will create dTSLA as well as DUSD by using the oracle prices that also can be seen here on defiscan.live. We already discussed this particular strategy in one of our earlier blog posts.

Contrary to that, if you buy the respective two tokens (dTSLA & DUSD) directly from the decentralized exchange (DEX), then you have to pay the price based on supply and demand; however this price could diverge from the price you see at outside exchanges.

Let’s assume you have 100 DFI and you want to swap that amount into DUSD. Due to the fact that more DUSD are currently being bought directly (demanded) than DUSD being minted (supplied), the price you are receiving is lower than the current “outside” market price of 4.328 USD –– you are receiving just 3.483 USD equivalent (prices taken from defiscan.live). That means if you were to swap your 100 DFI into USDT, then you would receive 424.2 USDT. That stands in stark contrast to just 348.3 DUSD. Conversely, this means that 1 USDT = 0.821 DUSD, as per writing of this blog post.

The inbuilt incentive function in the form of loan schemes coupled with the minting ability of new dTokens, should actually take care of the rebalancing of the most crucial pool –– the DFI-DUSD pool. Since the demand for DUSD is currently way higher than the incentive to mint new DUSD, we are about to change that by the following two implementations:

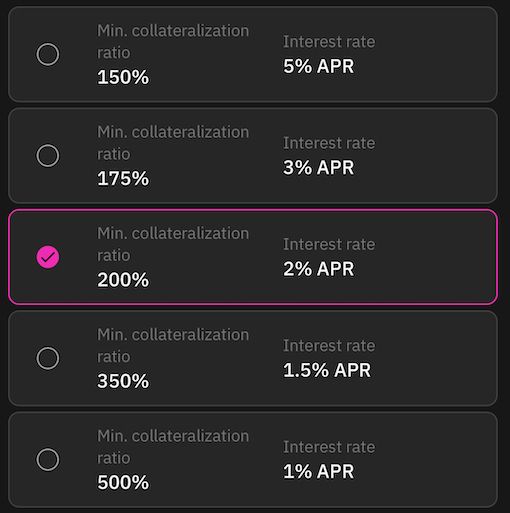

Introduction of new lower loan scheme tiers

One of the easiest ways to encourage users to mint more DUSD is by allowing them to take out more dTokens in the form of a loan. This can be done by lowering the minimum collateralization ratio, allowing the user to take out a bigger loan without being liquidated. This feature has already been implemented and is already live on the light wallet. As a result, you can now choose a new 150% or 175% loan scheme, following through with our Pink Paper promise.

Introduction of a funding rate

Funding rates are periodic payments that make sure that two “markets” are aligned and thus prevent lasting price divergences. By introducing funding rates for just the DUSD token, we will be offering an additional incentive to mint DUSD. This feature will be implemented after the improvement proposal is accepted. We are currently working on it and will communicate more in due time.

How will that work?

If the DUSD price is higher than the outside USD price, then minting new DUSD has to be incentivized even more. This is done by offering a periodic payment just for minting new DUSD. As a result, you mint DUSD, transfer them into DFI by taking advantage of the DUSD-DFI pool, driving down the price of DUSD, and are then even able to use these DFI to top up your collateral.

That’s all you have to do. Everything else will be automated. After the pool has been aligned, you can then swap your DFI back into DUSD to settle your loan. Since the incentive is strong, it will not take long until prices are arbitraged and the pools are aligned. And in the meantime you are getting paid for just taking out the loan and converting it into DFI.

Why do we need a funding rate?

In the first place we want to align the DUSD price to the “outside” price of USD. On the other side, though, all other dToken pairs are traded against DUSD. That means if you want to use DFI to buy dTSLA, then you first need to convert DFI into DUSD and then DUSD into dTSLA by using two different liquidity pools (DFI-DUSD & dTSLA-DUSD). Well, this is actually done automatically, but that’s at least the process in the background.

If both of these pools, respectively the equilibrium price, is not identical with the price supplied by oracles then you will either gain or lose by swapping DFI into dTSLA, depending on divergence of each pool. So in the end, you have to consider both pool prices in order to calculate the effective price you are paying for your dTSLA.

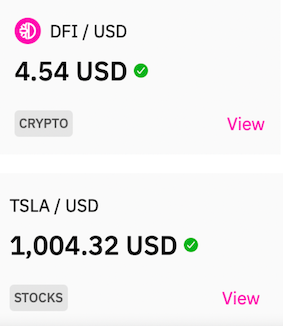

Let’s assume you want to swap 100 DFI into dTSLA and the pool prices are the following:

DEX price:

Oracle price:

In that case, minting the tokens would make much more sense, because you effectively “buy” DUSD for 1 USD and dTSLA for 1004.32 USD. If you were to swap DFI worth 1000 USD into DUSD then you would only receive 1000x3.35/4.54 = 737.89 DUSD –– more than 260 DUSD less than if you would have minted it.

It’s even worse when you would like to buy dTSLA directly. Swapping 1000 USD worth of DFI into dTSLA gives you: (1000x3.35/4.54) / 1155 = 0.6388 dTSLA shares, worth 641 USD.

All dTokens except DUSD itself are trading against DUSD. As such, if the DUSD-DFI liquidity pool is not balanced, you are massively losing out by swapping DFI into a dToken. And that’s exactly what we would like to prevent from happening by further incentivizing users to keep the crucial DUSD-DFI pool in balance.

If this was a bit too fast for you, or if you still have some questions, then we would kindly like to ask you to check out the DeFiChain Telegram group. Our amazing community is always here to help you!