The Best 3 Decentralized Exchanges for Swapping & Liquidity Mining

Decentralized exchanges offer a safe way to trade without the need for trusting any third party intermediaries, such as centralized exchanges or brokers.

The only thing you have to trust when using decentralized exchanges is the universal language of mathematics. This becomes especially important considering everything that is currently happening in the markets, such as policymakers restricting access to centralized exchanges in certain regions or trading apps like Robinhood halting purchases of certain stocks.

Decentralized Exchanges also offer a lucrative way to earn money for providing liquidity - something that usually only a few big players can benefit from, but through the market making system of decentralized Exchanges becomes easily available to everyone.

In this article we present the 3 best decentralized exchanges, evaluated based on the following criteria: Level of decentralization, security, and functionality. As a bonus point, we also consider how lucrative the providing of liquidity is for each decentralized exchange.

Top 3 Decentralized Exchanges - Evaluation Criteria in Detail

Level of Decentralization:

- Is the entire project open source?

- Does the Exchange actually run decentrally as an app on your computer, or is it centralized on a website that can theoretically be shut down?

- Can the code be easily changed by the developers?

Security

- Is the project turing-complete - and thus vulnerable to bugs & hacks - or have the capabilities been intentionally kept narrow to provide higher security?

- Has the code been independently tested and is open-source?

- How long has the Exchange been running without problems, or have there even been major hacks?

Functionality

- How high is the liquidity of the DEX?

- How many different coins can be exchanged?

- And how high are the fees that are charged for swapping coins?

Bonus-Point: Liquidity Mining Rewards

- How lucrative is it to provide liquidity for the DEX yourself?

The best 3 decentralized exchanges, from least to most recommended

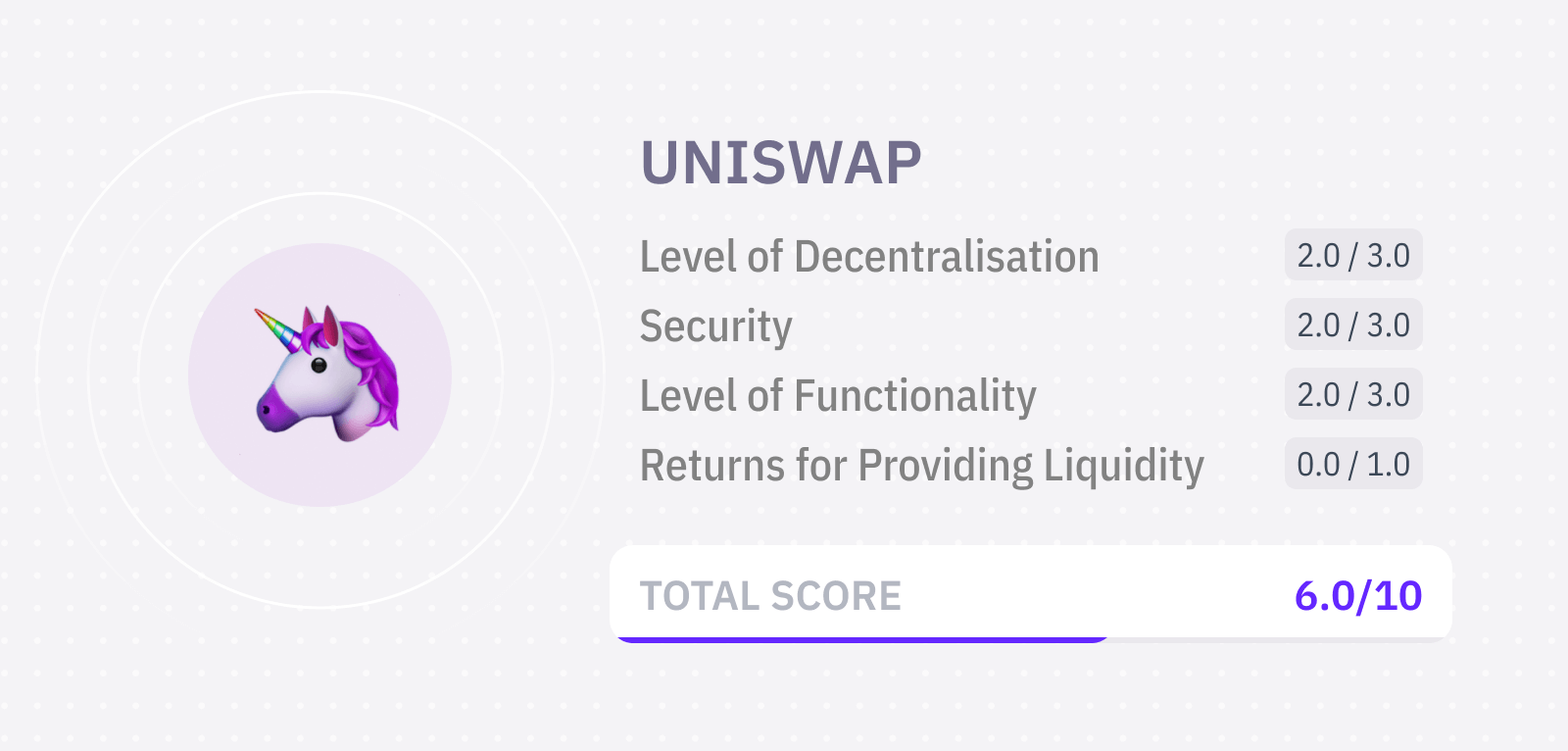

1. Uniswap

Uniswap is the first real decentralized exchange based on Ethereum, and currently by far the largest decentralized exchange in the entire crypto market. But being first in the crypto world doesn't necessarily mean being best - let's look at the analysis in detail:

Level of Decentralization at Uniswap

Uniswap is based on an Ethereum Smart Contract, which is publicly available on Github. The project is therefore already open-source.

Since the entire exchange is solely a smart contract that cannot be changed once it has been set up (and thus cannot be improved or fixed), Uniswap cannot simply be changed by the developers. For this, a new exchange is needed, and so there is Uniswap V1, Uniswap V2 and even V3 is planned soon. However, this restriction is definitely good for decentralization.

One criticism, however, is that the exchange is not actually used decentrally and without a third party (for example, by software that your computer runs itself), but runs via a website. This, of course, provides a point of attack and could be taken down.

We therefore give the level of decentralization at Uniswap 2.0/3.0 points.

Security at Uniswap

One of the most important aspects of any exchange is security - especially if it is decentralized and attackers cannot be stopped quickly once they have found a security hole.

The fact that Uniswap has been around for several years and that the open source code has already been independently tested several times is a definite advantage. Although funds have been stolen via Uniswap in the past, this had to do with the security of the assets listed on Uniswap, and not with the decentralized exchange itself.

However, one concern remains, and that is the turing-completeness of Uniswap. Because the smart contract is based on Ethereum - a blockchain that is not specifically geared for the functionalities of a decentralized exchange, but on which anything can be developed - it is difficult to close and identify all potential security holes. There are simply too many opportunities for potential attackers.

We therefore give Uniswap 2 out of 3 possible points in terms of security.

Functionality at Uniswap

Since Uniswap is currently by far the largest DEX (decentralized exchange), the available liquidity is also more than sufficient for most of the available trading pairs.

There are also no complaints when it comes to the number of available trading pairs. Virtually anyone can easily list an ERC-20 token, and thus most Ethereum ERC-20 tokens are also available on Uniswap, albeit with varying levels of liquidity, of course. However, all popular tokens are easily exchangeable even in larger quantities.

The big problem, however, is again that Uniswap is based on Ethereum. The fees for transactions are thus sometimes so high that one can hardly speak of usability - over $100 in transaction costs are simply not sustainable for the average crypto investor.

In terms of functionality, Uniswap therefore receives 2.0/3.0 points again.

Liquidity Mining Rewards at Uniswap

As a possible bonus point, we look at the liquidity mining rewards at Uniswap.

These were still relatively high some time ago when the DEX was launched, but they are naturally going down with increasing, basically competing liquidity providers. Nowadays, there are only transaction cost commissions, which are not too profitable due to the many liquidity providers.

So here we do not give Uniswap a point.

Overall, Uniswap therefore receives a rating of 6.0 out of 10 possible points.

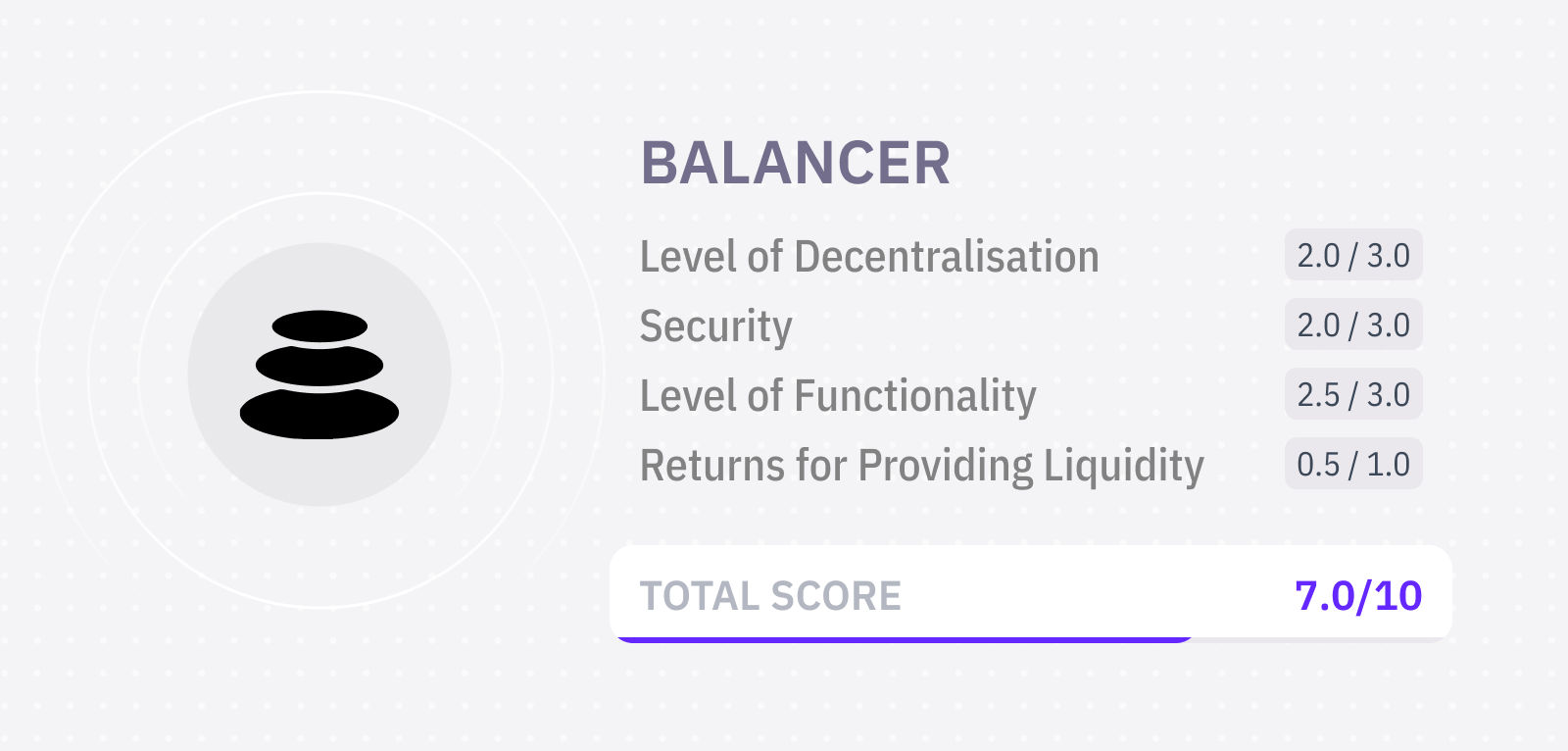

2. Balancer

The developer of the protocol for the decentralized exchange Balancer is the eponymous company Balancer Labs. The company was launched in 2019 by Mike McDonald and Fernando Martinelli and has already raised $3 million in a seed round. A detailed analysis:

Level of Decentralization at Balancer

Like Uniswap, Balancer is also based on Ethereum and has publicly accessible open-source code for its protocol.

The code cannot be changed and is therefore resistant to censorship, but potential security vulnerabilities cannot be easily closed or function updates applied. Balancer V2 was recently introduced for this purpose, which works more efficiently and is therefore more cost-effective.

The big problem is that Balancer is accessed via a company-run website - this could of course be shut down at any time, even if the company doesn't want to.

We thus give Balancer 2 out of 3 possible points as far as decentralization is concerned.

Security at Balancer

It is often falsely reported in the media that Balancer has already been "hacked" for $500,000 USD. However, the decentralized exchange itself was not hacked, but only the vulnerability of a listed coin was exploited. So far, the protocol itself is running without any major problems.

The code is open-source and has also been independently tested several times.

The problem with Balancer, however, is again that it is based on Ethereum, and thus vulnerable to bugs & hacks.

So overall, Balancer gets 2 out of 3 points.

Functionality of Balancer

The liquidity of the DEX is significantly lower than Uniswap, but still more than sufficient.

A special feature is that Balancer not only has two-pair pools, but even up to 8 different coins can be put into one pool. However, it should be noted that a liquidity pool is only as strong as the weakest link: If, for example, it contains a token that can be mined centrally, the rest of the pool can quickly be exploited.

And although Balancer is based on Ethereum, they have actually managed to reduce fees somewhat and make the decentralized exchange more user-friendly with V2 through technical sophistication. Trading is thus still expensive, but at least somewhat affordable.

In terms of functionality, Balancer therefore receives 2.5 out of 3 possible points!

Liquidity Mining Rewards at Balancer

Liquidity mining is definitely more lucrative on Balancer than on Uniswap, if only because there are significantly fewer other liquidity providers.

Even in absolute terms though, the reward payouts are currently still higher at Balancer.

However, you should definitely keep in mind that you have to claim your Liquidity Mining Rewards via the protocol first, which in turn costs fees for the Ethereum network. Of course, this can quickly become very expensive with Ethereum.

Nevertheless, we give Balancer 0.5 out of 1 points for this.

Thus, the Balancer DEX is rated with 7 out of 10 points overall!

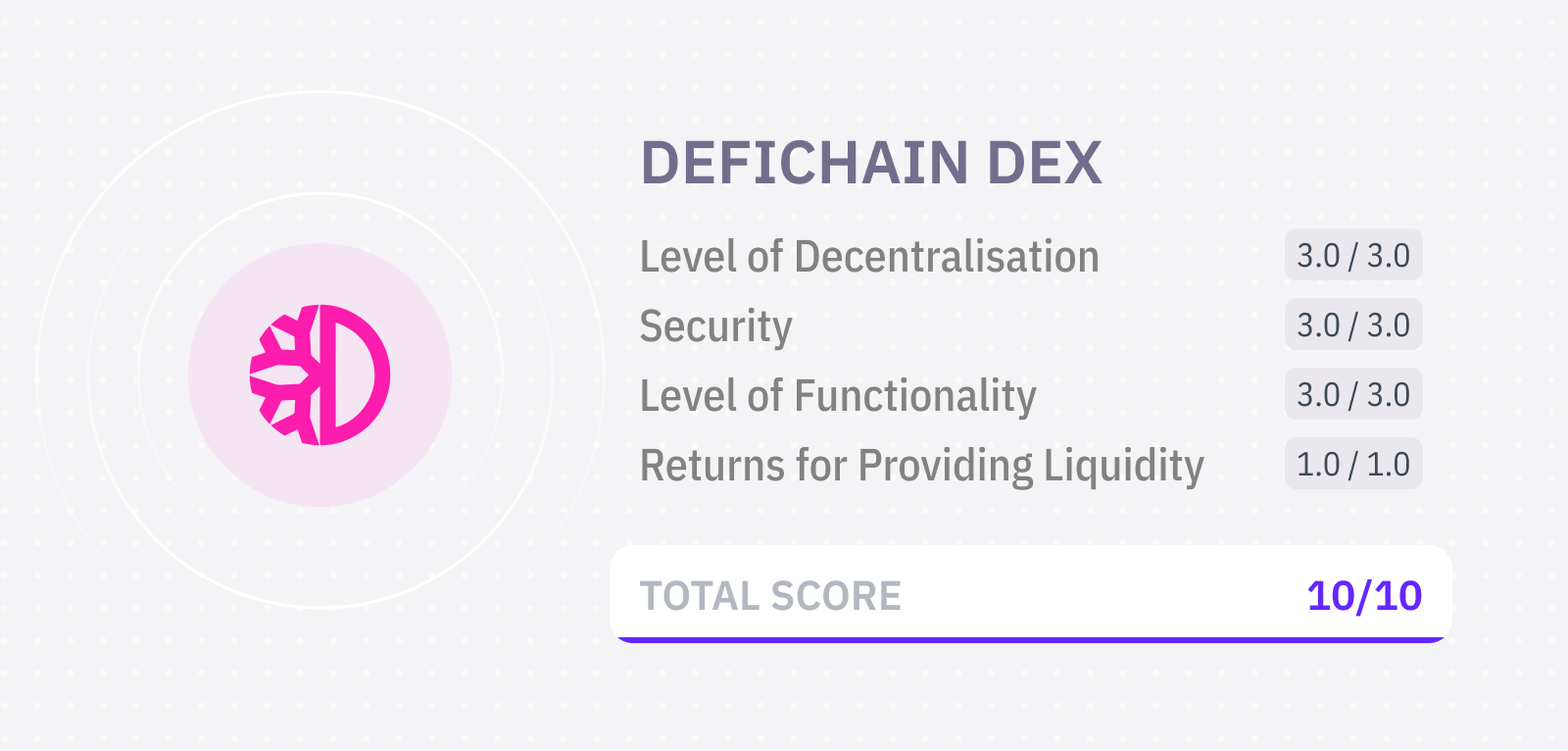

3. DeFiChain

The decentralized exchange that probably stands out the most from this list is the one from DeFiChain.

This DEX is not based on Ethereum, but on the DeFi blockchain, which was created specifically for such functionality and is a fork of Bitcoin.

The big advantages are increased security, faster and cheaper transaction costs, and easier programming, which allows for much faster progress.

And it enables one more great feature that no other DEX in the whole world can offer so far.... but let's look at everything in sequence:

Level of Decentralization at DeFiChain

Just like the rest of the decentralized exchanges so far, the DeFiChain DEX is of course completely open-source. Yes, even the entire blockchain code can be publicly viewed on Github.

However, an important difference to the other decentralized exchanges is that the DEX does not run centralized on a website, but completely decentralized as a downloadable app on your own computer. Thus, the exchange cannot be stopped!

Another advantage is that the exchange can thus even be updated and improved without compromising decentralization: An update of the app has to be executed and re-downloaded by yourself, as you are familiar with all your other apps already.

The DeFiChain DEX thus receives 3 out of 3 points for the level of decentralization.

Level of Security at DeFiChain

Since the DeFi Blockchain is based on Bitcoin, it is of course already fundamentally very secure. Just like Bitcoin, the entire Blockchain - and therefore also the DeFiChain DEX - is non-turing-complete.

This means that the functionality and development possibilities are strictly limited to what is necessary for Decentralized Finance applications. Where there are less possibilities in total, there are of course also less attack possibilities! Keeping the DEX secure is thus much easier than on Ethereum, where it is practically impossible to think of all the potential attack possibilities.

Since the day of the Bitcoin halving in spring 2020, DeFiChain is now already running on MainNet (i.e. not just in a test environment, but actually live) without any problems. The open source code has also already been independently verified.

We therefore give the DeFiChain DEX 3 out of 3 points in terms of security!

Level of Functionality at DeFiChain

The non-turing-completeness of DeFiChain in no way means that the DEX has less functionality than others. On the contrary, it is precisely this specialization that enables rapid progress and an efficient decentralized exchange.

This is also reflected in the functionality: not only is the Bitcoin liquidity pool so large that one could easily swap very large sums like $1 million US dollars without really affecting the price, but it is also the only DEX that has natively integrated Bitcoin via atomic swaps!

Further, the fees for decentralized exchanging are vanishingly small, especially compared to Ethereum. Even for large sums, just a few cents in fees are due.

And since all major coins like Ethereum, USDT, Litecoin or even the real Bitcoin (BTC) are available, you are also completely unrestricted in your trading.

The functionality of the DeFiChain DEX therefore receives a full 3 out of 3 points from us.

Liquidity Mining Rewards at DeFiChain

We now know that the DeFiChain DEX is great for decentralized asset swaps. But what about if you want to earn money as a liquidity provider?

Again, DeFiChain DEX does not disappoint and offers by far the highest rewards among the major decentralized exchanges. Even for the big pools like Bitcoin, Ethereum or USDT, where the coin risk is very manageable, the annual returns for providing liquidity are over +100%!

Best of all, the rewards are paid out in real time per block, roughly every 30 seconds, and are directly usable. No costly claiming like on other decentralized exchanges!

So DeFiChain definitely gets this bonus point from us, and thus ends up with all 10 out of 10 points. Wow!

Conclusion: Which decentralized exchange is the best?

Among the decentralized exchanges, DeFiChain DEX stands out with its true decentralization, comparatively extremely low fees and fast transaction times, as well as the ability to natively swap Bitcoin (BTC).

As a liquidity provider, the DeFiChain DEX is also by far the most lucrative.

If you want to profit from all of this, you can download the DeFiChain app here and get help from DeFiChain's Reddit community if you have any questions.

Otherwise, you can find the other two featured decentralized exchanges Balancer and Uniswap here.

Have fun decentrally exchanging!