Special DFIPs: A breakdown of what it means for DeFiChain

In this article, we will break down two recent Special DFIPs – DFIP #285 and DFIP #286 – both of which have been overwhelmingly approved by the community and will also examine their implications for DeFiChain and its investors.

What are DFIPs?

DFIPs, short for DeFiChain Improvement Proposals, are proposals brought forward by Masternode holders and voted on during scheduled voting cycles. To be approved, a proposal must receive at least a two-thirds majority. The same rule applies to Special DFIPs, proposals voted on outside of the regular voting cycle.

DFIP #285 Explained

DFIP #285 mandates that 90% of the unused $ETH held in the backing address will be staked at Bake. Moreover, at least of once per month, the $ETH staking rewards will be used to purchase $DFI from the DeFiChain DEX, after which the resulting $DFI will be burned. This process will be automated through a bot.

For full transparency, Bake has provided a separate on-chain address for ETH nodes, which can be verified on EtherScan:

Additionally, Bake will issue monthly statements detailing rewards and node information. The bot used for buying DFI from the DeFiChain DEX is also fully trackable.

DFIP #286 Explained

DFIP #286 mirrors DFIP #285 in most respects, but it focuses on $DOT, $SOL, and $MATIC rather than $ETH. As with DFIP #285, 90% of the idle $DOT, $SOL, and $MATIC in their respective backing addresses will be staked at Bake. Bake's backing addresses can be found here:

- DOT: 12YfgqECReN4fQppa9BDoyGce43F54ZHYotE77mb5SmCBsUk

- SOL: 9XeYumALc7r4TvBvnUYrZpMXdvxKQ4mxf2WsR1gxyNNH

- MATIC: 0x94fa70d079d76279e1815ce403e9b985bccc82ac (ERC20)

Similarly, staking rewards for $DOT, $SOL, and $MATIC will be used to buy $DFI from the DeFiChain DEX and burn the resulting $DFI, with the process automated via a bot.

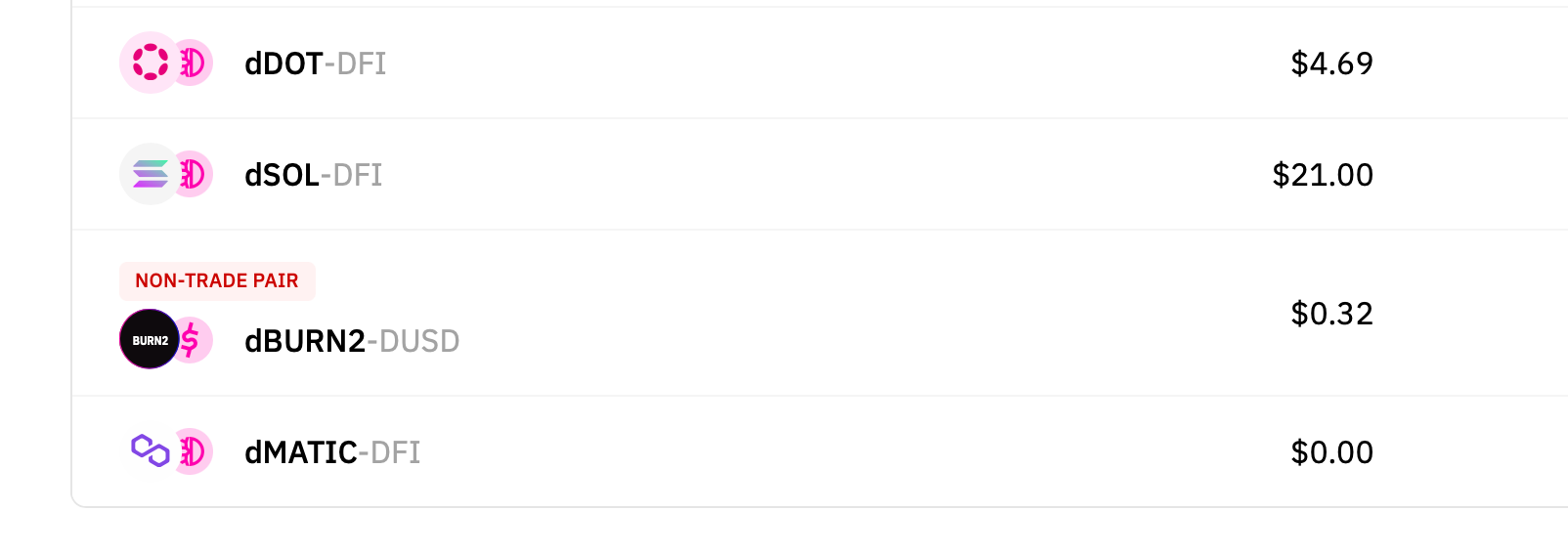

This proposal also introduces three new trading pairs to the DeFiChain DEX: dDOT-DFI, dSOL-DFI, dMATIC-DFI. These pairs will have the standard 0.2% swap commission for liquidity providers, but no additional block rewards will be offered for these liquidity pools.

Implications of Special DFIP #285 and #286

With the staking of 90% of the idle $ETH, $DOT, $SOL, and $MATIC, the remaining 10% will be reserved for instant float to facilitate the smooth unwrapping process for Bake customers withdrawing funds. The staking is estimated to generate approximately 1 million USD in rewards, all of which will be used to buy back $DFI and burn it. Consequently, these proposals are expected to support the DFI price by adding utility and increasing the buying pressure on the DeFiChain DEX.

Moreover, the team is exploring the possibility of generating a nearly 4% risk-free yield on 90% of the backed $USDT and $USDC through tokenized bonds, with a similar approach to the staking coins mentioned above.

Bake will charge its regular fees to execute this service to cover node and operational costs. Customers must also accept Bake's most recent terms and conditions regarding staking, which include acknowledging the inherent risks associated with $ETH staking.