Project Spotlight: MarbleFi

Project Spotlight: MarbleFi

Staking funds to run a masternode and secure the network often feels like locking away your crypto in a vault with limited utility.

But what if you could enjoy the benefits of staking without sacrificing flexibility?

In this spotlight edition, we highlight MarbleFi, a Liquid Staking derivative provider that enables DeFiChain masternode holders to use their locked-up capital more effectively.

What is MarbleFi?

MarbleFi, a groundbreaking product from Birthday Research (the R&D division of Cake Group) is redefining capital efficiency in the DeFiChain ecosystem.

Traditionally, funds committed to DeFiChain's Masternodes were effectively locked up, limiting their potential for further utilization.

However, MarbleFi allows for an innovative solution that unlocks this capital It empowers users to leverage their funds for other decentralized finance activities while continuing to collect the underlying yield from their staked positions.

Through its cutting-edge Liquid staking derivative model, MarbleFi breaks down the barriers that once restricted the flexibility of staked assets.

Users can now maintain their Masternode positions, continue earning rewards, and explore additional opportunities within the thriving decentralized finance landscape.

What is Liquid Staking?

Liquid Staking offers the most convenient way to earn rewards on your DFI holdings within the DeFiChain ecosystem.

To participate directly in DeFiChain's validator network, individuals must meet the requirements of holding and staking a minimum of 20,000 DFI, as well as running a DeFiChain Masternode to receive validator rewards.

Liquid Staking provides an alternative to this through the concept of staking service providers.

In the case of MarbleFi, native DFI coins are deposited with the Masternode Validator, which then issues a 'receipt' in the form of a liquid synthetic token called mDFI (Marble DFI). This 'receipt' accrues interest, representing the staking rewards earned on the deposited DFI.

MarbleFi simplifies the staking process by offering greater flexibility and control to users. There is no need to set up, operate, or manage your own Masternode Validator, as MarbleFi handles the complexities behind the scenes.

This innovative approach allows users to effortlessly participate in staking and earn rewards, while maintaining liquidity and the freedom to engage in other decentralized finance activities within the DeFiChain ecosystem.

How does it work?

For end-users, the process of utilizing MarbleFi is straightforward:

- Visit the MarbleFi dAPP page.

- Deposit DFI (MetaChain EVM) into the MarbleFi deposit contract.

- Receive mDFI (Marble DFI) tokens proportional to your deposit, based on the prevailing market prices.

- Utilize the mDFI tokens in other DeFi activities within the DeFiChain ecosystem where mDFI is accepted.

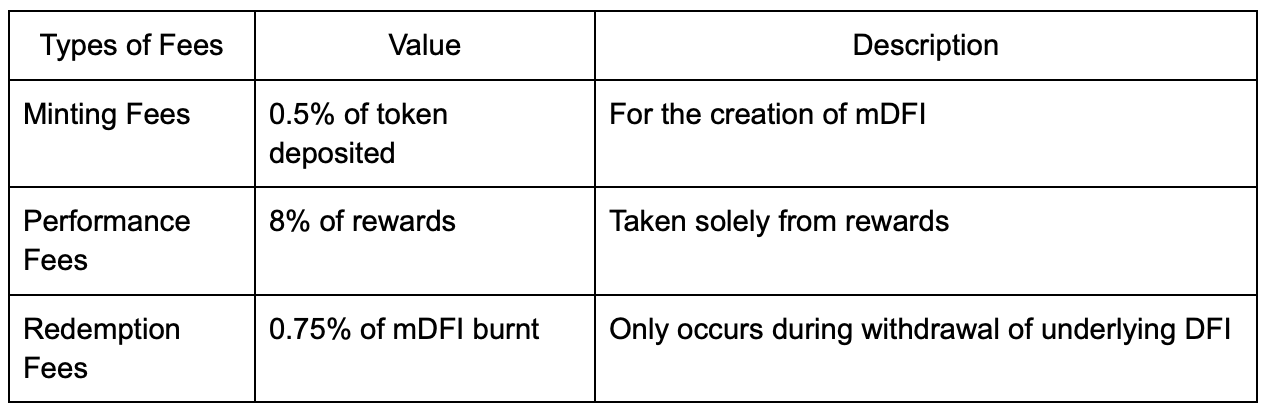

To allow for a sustainable ecosystem, MarbleFi has implemented the following fee structure:

These fees contribute to the system's operational sustainability, minimizing the reliance on heavy incentives.

Fees can be adjusted in the future based on community governance decisions, ensuring the ecosystem remains adaptive and responsive to changing needs.

By following these simple steps and understanding the associated fee structure, users can participate in staking and earn validator rewards without the hassle of managing their own Masternode infrastructure.

MarbleFi takes care of the intricate details, allowing users to focus on maximizing their returns and exploring opportunities within the vibrant DeFiChain ecosystem.

Are there risks associated with Liquid Staking?

Smart Contract Risks

Innovative decentralized applications like MarbleFi use transparent smart contracts to safeguard your funds without any custodial control, providing trust and assurance in the expected staking of your assets. However, like with any other smart contracts in the decentralized finance space, there is always the possibility that a new vulnerability could be discovered.

Liquidity Risk

The value of mDFI may fluctuate based on market demand and other factors, which could result in losses if the price drops. However, underlying each mDFI token, there is a minimum of 1 DFI plus accumulated DFI rewards.

DeFiChain Network Risk

MarbleFi is built on the DeFiChain EVM (MetaChain) network, so any network issues (such as network congestion or gas fees) could impact the service's availability or performance.

Taxation

Depending on the financial jurisdiction, mDFI may be subject to taxation. Users should consult with a tax professional to understand their tax obligations. MarbleFi will not be responsible for any tax implications.

It's crucial for users to carefully consider and understand these risks before engaging with the MarbleFi platform. While the innovative nature of the service offers potential benefits, it's essential to be aware of the associated risks and take appropriate measures to mitigate them.

Final Words

MarbleFi represents a groundbreaking innovation that unlocks new frontiers of capital efficiency and user empowerment within the DeFiChain ecosystem.

By introducing a cutting-edge Liquid Staking derivative model, MarbleFi breaks down barriers that once restricted the flexibility of staked assets, fostering a more dynamic and versatile DeFi landscape.

As MarbleFi continues to evolve, it promises to bring even more innovations and improvements, ensuring that users remain at the forefront of the decentralized finance revolution. Embrace the future of DeFi with MarbleFi, where capital efficiency and flexibility go hand in hand.

Check out their website to launch the service.