Pink Paper — Part I

In this ten minute reading article, you’ll learn about:

- DeFiChain’s newly introduced bug bounty program

- DeFiChain’s proposals regarding various governance related changes

An overall mission for DeFiChain is important, yet it’s even more crucial to have a detailed road map with quantifiable goals along that trajectory. Alluding to DeFiChain’s brand colors, a ‘Pink Paper’ is being developed, which is essentially a live paper, subject to constant change as specifications are added, that will set the overall direction of DeFiChain for the next year and beyond.

The ‘Pink Paper’ can be divided into two parts. The first deals with governance related aspects and the second part, technical questions concerning future use cases like decentralized tokenization, atomic swaps, interchain exchange or price oracles to name just a few. The ‘Pink Paper’ itself is open source, so anyone is welcome to participate. It can be found on GitHub.

This article will address some of the most important governance related topics, as well as focus on innovative DeFi concepts which are currently in progress and still to be implemented. For this purpose we will divide this article into two separate pieces, the first part will delve into the various governance related aspects like the evolution of the Community Fund and the DFI issuance. The second part will then address user-oriented DeFi concepts like atomic swaps, interchain exchange and price oracles to just name a few.

Overview

DeFiChain has been hugely successful since its first block was minted on 11 May 2020. It managed to grow its TVL to an astonishing US$ 290M in less than a year, while constantly focusing on DeFiChain’s mission to increase its generalization and decentralization efforts.

In an attempt to further decentralize the network, the collateral required to operate a masternode has been reduced from 1 million to just 20,000 DFI (see DFIP#4). Since the acceptance of the DFIP#4 proposal, users are now able to easily and safely set up their own masternodes directly on the DeFiChain Wallet App.

On the community side, DeFiChain couldn’t be prouder to have such a vibrant, welcoming and active community. Just recently, a bug bounty program has been introduced whereby DeFiChain is engaging security experts as well as with the community to identify potential vulnerabilities. A maximum of US$ 50,000 is available for those participants who find significant bugs and are able to provide useful information to be able to fix them. Our first bounty awarded over 5,000 DFI, equivalent to more than US$ 17,000, was granted to Dr. Daniel Cagara for his discovery of a critical security related bug, which has already been fixed and upgraded.

DeFiChain Governance Aspects

Foundation

The DeFiChain Foundation was created as a non-profit organization in November 2019 to kickstart the DeFiChain blockchain. DeFiChain Foundation was needed in the early days of the project, such as to register addresses and various administrative reasons, yet it has now outlived its general purpose.

As a result, DeFiChain is aiming to abolish, or respectively greatly diminish the role of the DeFiChain Foundation. This means the future governance won’t be carried out by the Foundation any longer and instead, DeFiChain will run solely by the community through masternode voting. This also has some immediate implications to the DFI coins held by the Foundation.

The DeFiChain Foundation currently holds more than 285M DFI in two different DFI wallet addresses. The first wallet address runs under the name of ‘Foundation Wallet’ and currently holds 273.7M DFI coins, whereas the second wallet address also known as the ‘Community Fund’ holds 12.2M DFI coins. However, the Community Fund wallet is not legally owned by the DeFiChain Foundation, it just acts as a “caretaker”.

In order to be able to put the governance into the hands of the community — respectively the masternodes — DeFiChain is proposing to burn all 273.7M DFI coins currently held in the Foundation Wallet. In accordance with the original white paper, a DFIP proposal (DFIP#7) has been introduced and upon masternode approval, the plan to burn all the Foundation Wallet coins will then be undertaken.

On the other hand, the Community Fund will not get burned, but restructured. As a result, the private key of the wallet address in question, which is currently held by the Foundation, will be destroyed and simultaneously replaced by the same amount of DFI coins into a consensus-managed smart contract. The most tangible application from all of this is that masternodes will then be able to vote on how these funds will be spent and which community projects will be funded and which projects won’t.

Community Funding Proposal (CFP)

Community Funding Proposals, or short CFP, are currently requested by reaching out to the Foundation via Twitter, Telegram or other social media channels and put up on DFIPs GitHub repo. This can be tedious for both parties involved, in the sense that it not only takes time for the Foundation to process all these requests, but the Foundation is also reluctantly acting as the gatekeeper for all these funds.

In the spirit of further decentralizing the network and the consensus, the CFP will also be placed into the hands of the community as soon as the Foundation Wallet has been abolished. This has been proposed in the DFIP#9 proposal and translates into the CFP being a full on-chain and decentralized governance mechanism, where everyone is free to request for funding by filing a CFP proposal.

To prevent this governance mechanism from getting abused and spammed, a fee of 10 DFI per proposal will be introduced, of which half is burned (you can find more on fees later in this article) and half is distributed equally among all voting masternodes. This actually kills two birds with one stone whereby the fee is prohibitively high enough to prevent spamming, yet low enough to not deter any serious projects from making a request for funding, ultimately contributing to DeFiChain’s decentralization.

A simple majority of 50 percent and 1 vote from all non-neutral voting masternodes is enough to pass a CFP proposal. Such a masternode vote will take place every 70,000 blocks or roughly every 30 days. In contrast to many other projects, DeFiChain will support the payout of the funding in tranches and will encourage masternode holders to consider approving projects which have an inherent milestone approach, where funds are paid out based on completion on a monthly basis.

With most other blockchains, masternode holders are only interested in how much APY they can squeeze out of their investment and don’t really care much about the governance aspect. DeFiChain wants to change that by incentivizing masternode holders to cast their vote on CFP proposals. As a result, masternode holders, who cast their vote (any vote will count), will receive a share of the CFP set-up fee — which is set to be 5 DFI per proposal, with 5 DFI to be burned — as an incentive to actively participate in DeFiChain’s governance.

This on-chain process is supported by a companion website to track and facilitate discussions before each voting process is carried out. It is essentially nothing more than a discussion platform, where the founders can pitch projects to the community and can actively discuss any questions the community might have.

DFI Issuance

As mentioned in the white paper, DeFiChain initially launched with a 200 DFI block reward, of which 10 per cent goes into the Community Fund. The Foundation pledges to guarantee this 200 DFI block reward for at least 1,050,000 blocks since the first genesis block was mined, so for approximately 1 year. Subsequently, block rewards will be adjusted through governance votes.

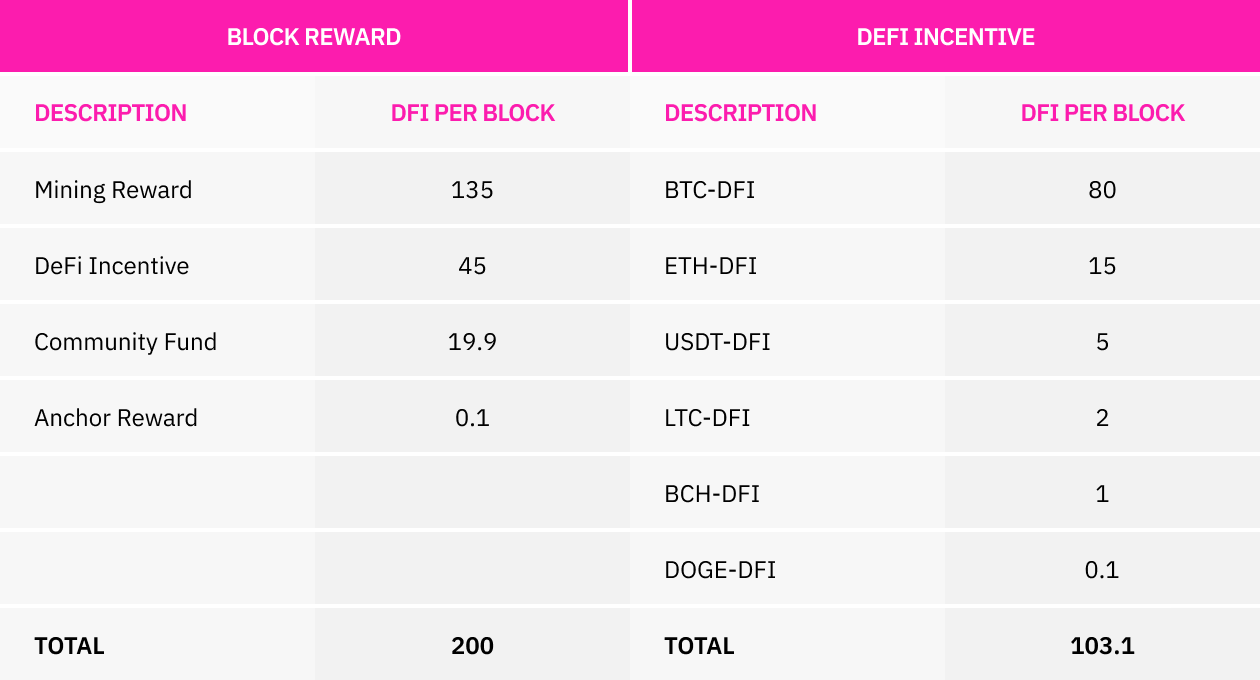

With the approval of the Bitcoin Anchor Reward proposal (DFIP#1) and the Incentive Funding proposal (DFIP#2), the initial agreed upon block reward payout structure has changed. A total of 45 DFI per block is currently going to the DeFi incentive funding smart contract which periodically pays out the rewards to the liquidity mining pools (DeFi incentive). However, if you sum up all DeFi incentive rewards being paid out through various liquidity mining pools, then you’ll see that there is a discrepancy of 58.1 DFI (see Table 1).

Consequently, this 58.1 DFI (103.1 - 45 = 58.1) must come from somewhere else, in this case the Airdrop fund. As of 13 April, the Airdrop Wallet currently holds 1.69M DFI and will be running out of DFI approximately at block height 805,750, or roughly 12 days (around 26 April 2021). This issue causes uncertainty in the DeFiChain community and needs to be addressed sooner than later. Therefore, a new issuance structure shall be put in place after masternodes have been voted and agreed upon.

DFI Issuance Proposal

For the DeFiChain community it is most important to have a clear expectation of the issuance structure and procedures for the foreseeable future. The proposed plan includes keeping the emission rate unchanged — at least for the first cycle after this proposal has been implemented (more on that can be found in the DFI Issuance Cycle subsection).

The rather hard emission rate decrease proposed in the white paper would thus be off the table. As an immediate result of this, the “halvening” effect wouldn’t only “soften” — by using a linearly decreasing emission function —, but would also take out the speculative price element that always accompanies “halvening” events.

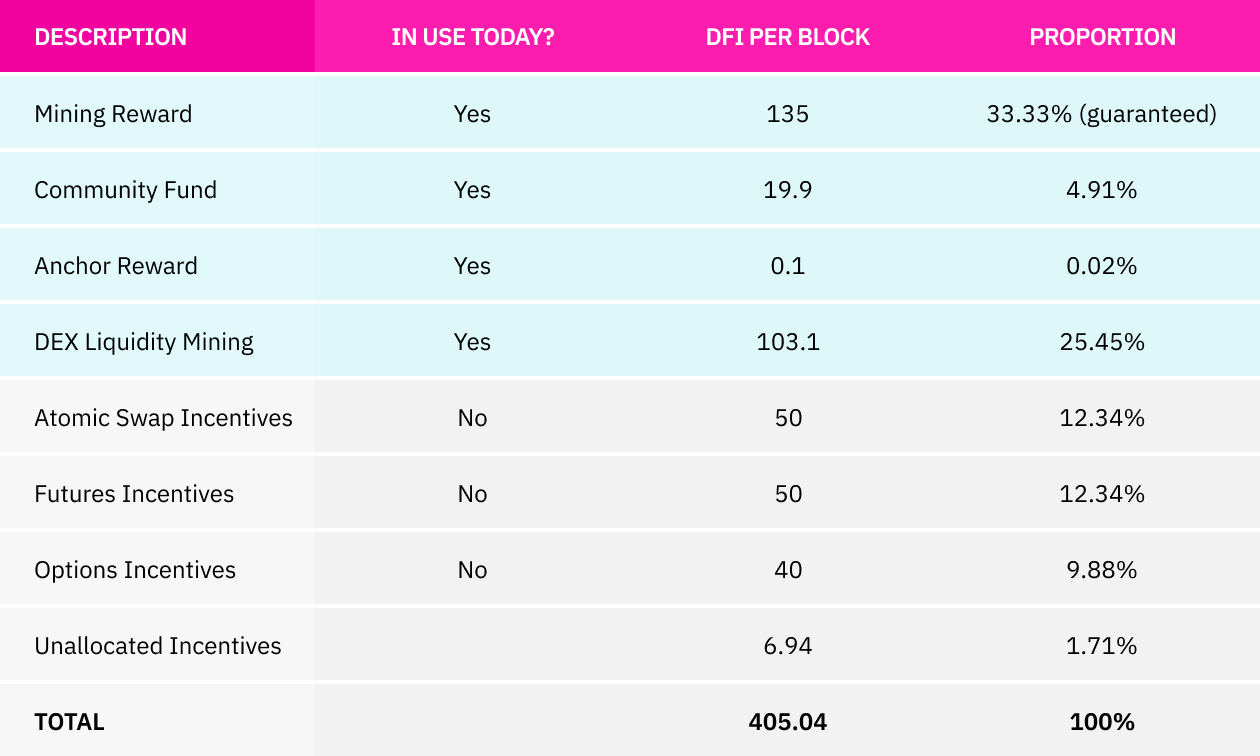

The goal is to create an incentive structure for current and future products which gives the community some degree of assurance regarding their future investment decisions. Neither the hard cap of 1.2B DFI (max. circulation), nor the current masternode mining rewards of 33.33 percent of the total block rewards wouldn’t get touched by this proposal. The proposed emission rate of the DFIP#8 proposal for the first cycle are shown in Table 2.

The first four rows highlighted in Table 2 refer to the current emission rate (rewards are coming from the block rewards and the airdrop fund) of 258.1 DFI per block. In the first cycle of the proposed emission rate restructuring process, these rewards will remain the same.

On the other hand, DeFiChain also has to foresee contingencies which might change this proposed reward structure. Most, if not all possible contingencies have already been mapped out as milestones in the road map, which makes it rather easy to incorporate them into the emission cycle. Nevertheless, the proposed incentive rewards for products that are not yet live (the last four rows in Table 2) may change depending on APY, competitive considerations and further product rollouts.

Since not all future products have been rolled out yet, it is important to emphasize that the rewards shown in Table 2 for products which aren’t live yet, will get burned and won’t be distributed in another way either. Hence, the total amount of 405.04 DFI per block will only be handed out to miners and liquidity providers if all future products have been introduced and are running on DeFiChain’s decentralized wallet app.

Also note, the masternode mining reward proportion of the total block rewards is guaranteed at 33.33 percent. This allows miners to plan well ahead with their investment decisions. For the rest of the incentive rewards there will be on-chain governance where the community can vote on future changes.

DFI Issuance Cycle

To give a clear perspective about the future DFI issuance and to prevent a sudden drop in APY, a continuously decreasing emission rate approach (DFIP#8) will be proposed to comply with the emission cuts outlined in the white paper. Every 2 weeks, or 32,690 blocks, the total incentive rewards will be reduced by 1.658 percent. As a result, the total incentive rewards will be reduced from 405.04 DFI to 398.32 DFI after the first cycle and to 391.72 DFI after the second cycle. Figure 1 gives a graphical overview about the decreasing block reward structure.

The proportions outlined in Table 2 will be maintained and the ⅓ mining reward proportion is also set in stone and can’t be overturned by a community vote. Following through with this proposal would mean that 1,188,259,185 DFI would be issued in 10 years (inclusive of burned amount). That’s equivalent to a 99.02 percent issuance of all DFI ever to be released (hard cap is 1.2B DFI). The issuance curve is geometrical by nature and will asymptotically approach 1.2B DFI coins, but will never hit that target.

Introduction of an Operator

If the proposal is accepted and the DeFiChain Foundations is abolished, then there remains the need to keep the blockchain generalized in a sense that anyone can utilize the blockchain alike. The blockchain itself should not be the entity that issues new tokens, manages the DEX or appoints oracles. Hence, DeFiChain wants to introduce a role called operator to take over all these duties and keep the blockchain clean.

Anyone will then be able to create an operator on the DeFiChain blockchain for a small fee that then is then burned. The operator itself will be responsible for:

- Creating asset tokens (DAT)

- Managing the DEX

- Appointing oracles

- Setting lending rates, etc.

Most importantly, though, the operator on DeFiChain doesn’t face the same issues as on Turing-complete blockchains where hacks and malicious attacks frequently occur. DeFiChain’s remedy to that is its native DeFi approach, which secures every offering carried out by the operator. This makes the interaction with the operator for DeFiChain users not only straight forward, but they also don’t have to worry about the smart contract bugs

Fee Structure

If you currently transact on the DeFiChain blockchain, then you have to pay a ‘Miner fee’ to the masternode that mints the next block. This is basically the same as other blockchains including Bitcoin and Ethereum.

With the introduction of operators, a new fee called ‘Operator fee’ will be implemented to incentivize operators to offer their products on the blockchain. Each operator can set the fee amount to be paid themselves, and it doesn’t necessarily have to be paid in DFI, it can also be paid in the operator's native token.

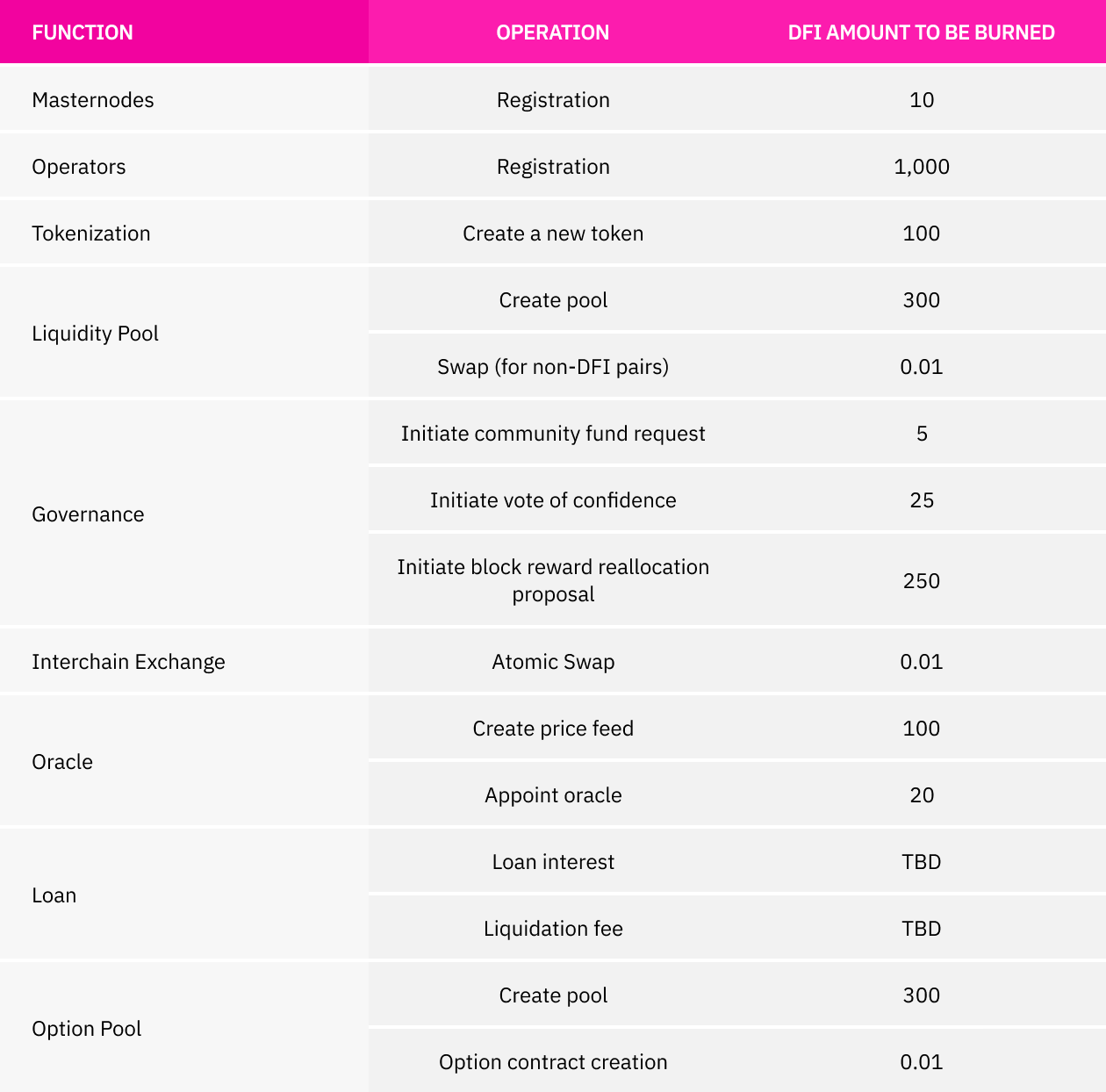

Lastly, a ‘DeFi fee’ will be introduced to aggregate all DeFi related operations that incur a (set up) fee to function under one roof. Think about it as the fee already charged to set up a masternode or the registration fee of an operator in the future — all these operations will require a certain amount of DFI to be paid which will then get burned (see Table 3).

Table 3 highlights the proposed fee structure and should be merely seen as a visualization of how the fee structure could look like after masternode approval.

Summary

In the first part of the Pink Paper we focussed on governance related changes and proposals regarding the DeFiChain Foundation, Community Funding Proposals and various topics related to the issuance of DFI. In the second part of the Pink Paper you’ll be able to learn more about the Interchain Exchange, Atomic Swaps, Oracles, Futures and even NFTs.

To stay up-to-date with the current numbers, we kindly suggest checking out our live Pink Paper on GitHub.

To keep up-to-date with the latest information and news, feel free to follow us on Twitter or join our Telegram group.