MicroStrategy Stock Split and Its Implications for DeFiChain

MicroStrategy recently announced a major change for its shareholders — a 10-for-1 stock split set to occur on August 7, 2024.

This event will have notable repercussions for traditional market investors as well as those engaged with decentralized finance (DeFi) platforms, particularly DeFiChain, where dMSTR tokens can be traded and invested into various products.

What Traditional Investors Need to Know

For traditional investors, the stock split means that for every share of MicroStrategy (MSTR) owned, they will receive ten shares post-split.

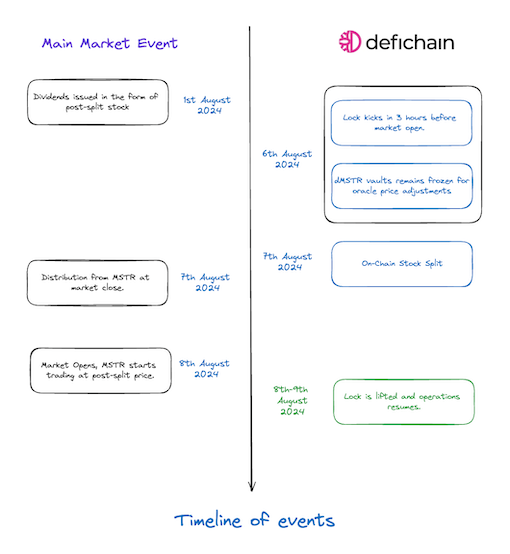

This split is scheduled to take place at the close of the market on August 7, 2024, at 4:00 PM ET (August 8, 2024, 4:00 AM SGT). Trading will resume at the new split-adjusted price when the market opens on August 8, 2024, at 9:30 AM ET (August 8, 2024, 9:30 PM SGT).

This adjustment aims to make MSTR shares more accessible to a broader range of investors by lowering the per-share price without affecting the company's overall market capitalization.

Impact on DeFiChain and dMSTR

DeFiChain users who hold dMSTR tokens will see direct implications from this stock split. Unlike traditional securities, dMSTR tokens rely on price oracles to mirror the value of MSTR shares.

Here are the key changes and how they will affect DeFiChain users:

- Token Adjustment: Similar to traditional shares, dMSTR token owners will receive 10 tokens for every 1 token they own pre-split. This adjustment ensures that the value of dMSTR tokens aligns with the split-adjusted price of MSTR shares.

- New Token ID: Post-split, a new token ID will be assigned to dMSTR. For most users, this change will be seamless, but it's important to be aware of this update.

Execution on DeFiChain

The stock split will trigger a specific protocol on DeFiChain to maintain system integrity and price stability:

- Lock Period: A 6-hour lock period will be enforced around the stock split—3 hours before and 3 hours after. During this time, users will not be able to interact with dMSTR on the decentralized exchange (DEX). This measure prevents any unstable pricing from affecting transactions.

- Vault Halt: Following the lock period, there will be an additional 1-hour halt on vault operations involving dMSTR. This standard safety mechanism ensures all systems are properly aligned with the updated token values.

- User Actions: Most users do not need to take any action. The process will be automated, ensuring a smooth transition. However, users on DeFiChain’s MetaChain layer (EVM) are advised to manage their dMSTR-impacted funds appropriately by transferring them back to the native DeFiChain layer.

Technical Insights

For those interested in the technical details behind this mechanism, the May 2022 Tech Talk episode provides a deep dive into the system's design. This conservative approach, including the lock period, ensures stability and accuracy during significant events like stock splits.

Summary

MicroStrategy's 10-for-1 stock split is set to make its shares more accessible to a broader range of investors. For DeFiChain users, this event necessitates adjustments to dMSTR tokens to ensure value consistency.

The automated processes, including the lock and halt periods, ensure a seamless transition with minimal disruption to users. As DeFi and traditional finance continue to intersect, understanding these dynamics is crucial for savvy investors and DeFi enthusiasts alike.